However, credit growth exceeded VND2.3 quadrillion, up by 14 percent compared to the country’s credit growth of 13.7 percent. The business performance of the city’s banking industry last year continued to maintain the growth rate in both scale and efficiency. The total assets of credit institutions in the city rose by 13.5 percent compared to those in 2018. Non-performing loans were controlled and written off positively.

To complete the task of the banking industry this year, the SBV-HCMC Branch will continue to carry out well the administrative reform, develop banking services, create utilities and improve operational efficiency, aiming to basically change the revenue structure. Of which, the proportion of the revenue from the non-credit services in the total revenue of commercial banks will be raised to 16-17 percent, improving risk management efficiency.

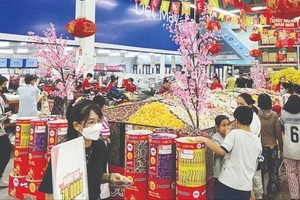

Mr. Dao Minh Tu, Deputy Governor of the SBV, said that with a credit target of 14 percent that the banking industry has set for this year, the cash flow will be directed to priority sectors and the credit quality of high-risk sectors, including real estate, will continue to be controlled. Commercial banks must be cautious when pumping money into the real estate sector, bad debts might increase again anytime as this happened before. The current bad debt proportion of the banking industry is 3.5-3.6 percent compared to that of 10.6 percent in 2016 and the target for bad debt proportion is below 3 percent this year. The promotion of writing off bad debts always accompanies with controlling of credit quality and minimizing bad debts. He asked credit institutions in the city to pay more attention to ensuring security and safety in payment, fully meet cash demand for the market, especially during peak times, such as year’s end and lunar New Year, and prevent the situation of a shortage of cash or loss of cash in transactions via automated teller machines and points of sale.

To complete the task of the banking industry this year, the SBV-HCMC Branch will continue to carry out well the administrative reform, develop banking services, create utilities and improve operational efficiency, aiming to basically change the revenue structure. Of which, the proportion of the revenue from the non-credit services in the total revenue of commercial banks will be raised to 16-17 percent, improving risk management efficiency.

Mr. Dao Minh Tu, Deputy Governor of the SBV, said that with a credit target of 14 percent that the banking industry has set for this year, the cash flow will be directed to priority sectors and the credit quality of high-risk sectors, including real estate, will continue to be controlled. Commercial banks must be cautious when pumping money into the real estate sector, bad debts might increase again anytime as this happened before. The current bad debt proportion of the banking industry is 3.5-3.6 percent compared to that of 10.6 percent in 2016 and the target for bad debt proportion is below 3 percent this year. The promotion of writing off bad debts always accompanies with controlling of credit quality and minimizing bad debts. He asked credit institutions in the city to pay more attention to ensuring security and safety in payment, fully meet cash demand for the market, especially during peak times, such as year’s end and lunar New Year, and prevent the situation of a shortage of cash or loss of cash in transactions via automated teller machines and points of sale.