On November 18, MobiFone become the first mobile network carrier allowed to pilot the Mobile Money service nationwide until November 18, 2023. In the first stage, it welcomes service registration in its 600 shops throughout the country, and will soon expand this signing-up to over 10,000 agencies or partners.

Following MobiFone is the pilot scheme of VinaPhone, which is ready to serve customers online and offline. Its clients can register for the service in either a smartphone or a basic one via the app VNPT Pay or an SMS.

Going last in launching the pilot program is Viettel, which also introduces Viettel Money – a digital financial ecosystem with over 300 utilities customized in accordance with each client as to purchases, money transfer, investment, insurance payment, service payment.

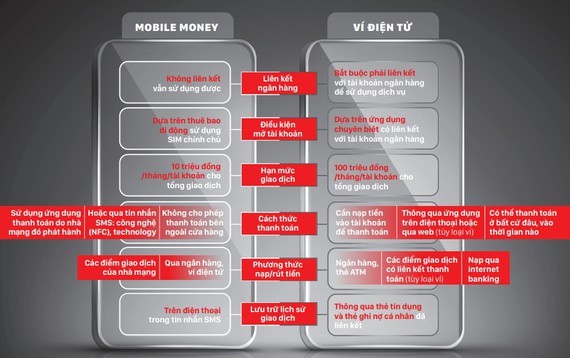

The strength of the Mobile Money service lies in its ability to allow subscribers to use their telecoms account for various transaction kinds like small-sum payment for goods and services, money transfer, money deposit and withdrawal directly at any stores or transaction points of the carrier without the requirement of a bank account, a smart phone, or an Internet connection.

To use this Mobile Money service, users must first register with the network provider as a formal subscriber. Their SIM must be in used for at least three consecutive months.

However, since the Internet can be accessed easily by people owning a smart device and signing up for a 3G or 4G service, financial activities can be carried out conveniently through various apps. This has posed a harsh competition for the Mobile Money service.

MobiFone admitted that time is needed for the service to be used in remote areas. Because this carrier is just in the first stage of the pilot, it is impossible for citizens of faraway areas to enjoy the service.

VinaPhone, meanwhile, raises another challenge when saying that many people in remote areas are not even used to depositing money into their telecoms accounts via scratch cards, let alone transfer or receive money or paying for goods and services.

A CEO in the digital finance field commented that the Mobile Money service is only suitable for remote areas where digital financial services are still limited. It proves useful in places where the 3G and 4G networks are unstable or unavailable, and people only own a basic phone.

“Obviously, the Mobile Money service will face severe competition from other financial services like e-banking or e-wallet in crowded or urban areas. Thus, it is wiser to establish it only in locations in need like the countryside, islands, and mountainous areas. That is the correct way to implement Decision No.316 by the Prime Minister about boosting cashless payment via Mobile Money,” said a financial expert.