Trường made the observation following the sector’s good results in the first quarter thanks to rapid growth from new markets such as Eurasian Economic Union (EAEU), which saw a growth rate of 115 percent in Russia; and the Asian Economic Community (AEC) with growth of 17 percent, 11 percent, 38 percent, 24.5 percent, 36 percent and 5 percent from Thailand, Indonesia, Singapore, Laos, Cambodia and Myanmar, respectively.

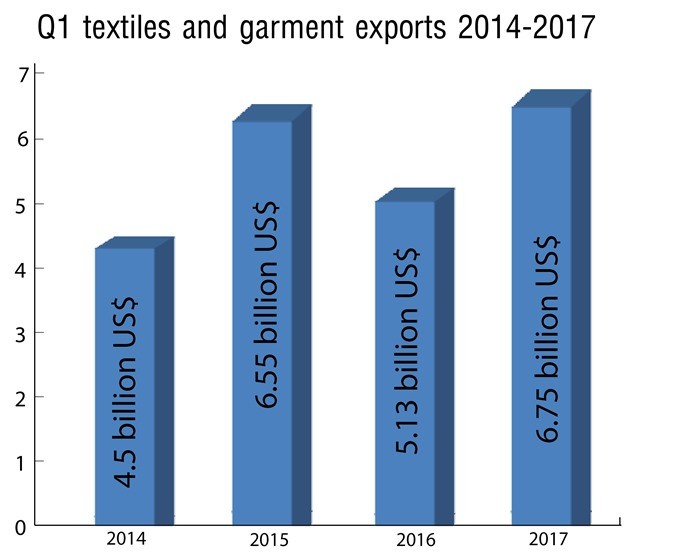

Statistics showed that the sector earned US$6.75 billion from exports in the first quarter of this year, growth of 12.4 percent compared with the same period last year.

Although the sector faced many challenges in exports to key markets, including low growth rates of exports to the European Union and the United States of between 6.3 percent and 6.4 percent, traditional markets such as South Korea, Brazil and India, maintained high growth between 14 percent and 34 percent.

Truong said the sector saw good growth in exports of many new products including swimsuits and raincoats with 29 per cent and 41 percent, respectively.

“We can see that our efforts in using initiatives to access markets and exploiting bilateral and multilateral trade agreements have produced results, mostly in the EAEU and AEC,” said Truong.

Insiders said that firms in the textiles and garment sector, particularly Vinatex, had performed well in recent years. They had foreseen difficulties of European markets and the failed Trans-Pacific Partnership agreement before devising their own ways to promote business overseas with new products.

New markets and new products have developed strongly since June last year when the businesses saw the advantages of trade agreements under negotiation between Vietnam and other countries. They concentrated on improving capacity, cutting costs and production prices even though domestic basic expenditures continued rising while the forex rate was stable.

In exports, the stable forex rate is a problem for businesses, particularly with Vietnam’s rivals, including China, India, Bangladesh, Pakistan, Indonesia and Malaysia, devaluing their domestic currencies in order to keep their market shares.

“We textile and garment businesses always expect that in macro policies, there would be calculations to balance the Vietnamese dong’s forex rate and the currencies of other countries to raise their competition in exports,” Truong said.

The businesses also hoped to enjoy a proper loan interest rate, similar with that of other countries, to help businesses cut costs, said Truong.

Truong said he believed that the sector could reach the growth rate target of 10 percent this year. This was a high target but with efforts from the entire sector it’s a reachable figure.