|

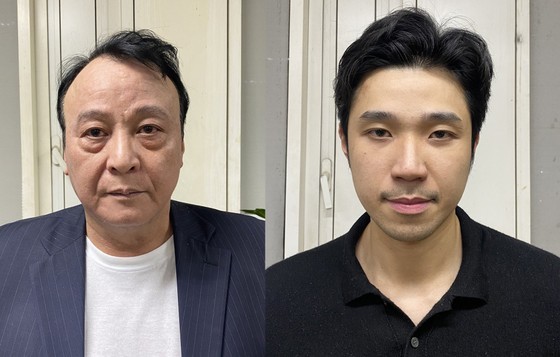

The defendants Do Anh Dung (L) and Do Hoang Viet |

Out of the 15 individuals recently charged by the Supreme People's Procuracy for the offense of "Fraudulent appropriation of property" at Tan Hoang Minh Hotel and Trading Service Company Limited (Tan Hoang Minh), Do Hoang Viet, son of Do Anh Dung, Chairman of the Board of Directors of Tan Hoang Minh, is alleged to have suggested the issuance of bonds as a means to commence the misappropriation of trillions of Vietnamese dong from investors.

The prosecution accuses Dung of being the key figure overseeing, directing, and making top-level decisions regarding economic activities within Tan Hoang Minh and its affiliated companies. In response to the business's challenging circumstances, Dung instructed his son, Viet (who was responsible for finance at Tan Hoang Minh), to explore capital sources through the issuance of private placement corporate bonds.

Additionally, Dung established a bond business center under Tan Hoang Minh and assigned his son to oversee and manage bond sales, as well as the mobilization of funds from bond purchasers. Daily financial data resulting from bond issuance was regularly reported to Dung through the finance accounting center and the office of Tan Hoang Minh.

The prosecutor's office asserts that Viet is accused of recommending the initiative to issue bonds as a means of fundraising for Tan Hoang Minh.

Accordingly, Viet directly managed and directed the finance accounting center to fabricate the bond issuance documents, coordinating with the Vietnam Audit Company and Hanoi CPA Company to legitimize the financial statements of the three issuing companies to meet the conditions for bond issuance.

Viet also directed the signing of falsified bond transfer contracts, creating fabricated cash flows for Tan Hoang Minh Company (a subsidiary of Tan Hoang Minh) to become the primary bondholder to sell bonds. He discussed and reached an agreement with his father on the use of the entire amount raised for unauthorized purposes deviating from the issuance plan, facilitating his father in misappropriating over VND8.64 trillion from investors through the issuance and trading of nine bond packages. To date, Dung has had his family return over VND5.65 trillion to mitigate the consequences of the case.