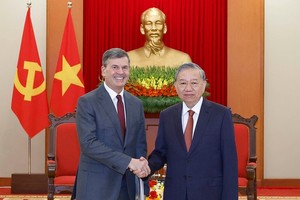

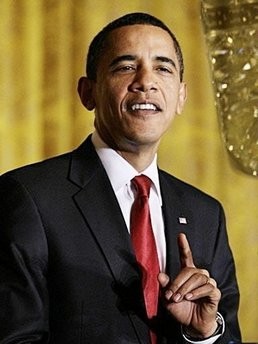

President Barack Obama unveiled plans Thursday to limit the size and scope of US banks and finance firms in a new assault on the Wall Street excesses laid bare by the financial crisis.

"Never again will the American taxpayer be held hostage by a bank that is too big to fail," Obama vowed, flanked by former Federal Reserve chief Paul Volcker, who advised the president on the rules.

The plans to limit "excessive" risk taking and "protect" taxpayers are aimed at preventing banks or finance institutions from owning, investing in or sponsoring hedge fund or private equity funds.

They will effectively force finance firms to choose between proprietary activities, trading in stocks and sometimes risky financial instruments and commercial activities, like making loans and collecting deposits.

The initiative, which must be approved by Congress, includes a new proposal to limit the consolidation of the finance sector, placing broader limits on "excessive growth of the market share of liabilities" at the largest financial firms.

Obama blamed banks for sparking the worst economic crisis since the Great Depression with "huge reckless risks in pursuit of quick profits and massive bonuses" in a "binge of irresponsibility."

He vowed to enact the reforms in Congress, even if Wall Street deployed an army of lobbyists to kill them.

"If these folks want a fight, it's a fight I'm ready to have," he vowed defiantly.

The announcement was the latest attempt by the White House to harness popular fury at massive Wall Street bonuses and the financial crisis, which is adding up to an angry political mood in a crucial election year.

Separately, the Federal Reserve and other US regulators ordered banks Thursday to follow tougher rules on capital requirements and accounting standards starting in November.

"Banking organizations affected by the new accounting standards generally will be subject to higher risk-based regulatory capital requirements," said a joint statement by regulators.

The new accounting standards require banks to include a number of off-balance sheet items in their liabilities, which could raise capital requirements.

Wall Street gave an immediate thumbs down to Obama's plans as US stocks plunged, with the blue-chip Dow Jones Industrial Average down more than 200 points or two percent.

"Rather than arbitrarily banning certain activities, or setting arbitrary size limits, our policy response should focus on improving risk management, internal controls, corporate governance, and supervisory oversight," said the Financial Services Forum.

It is a nonpartisan group of the chief executives of 18 of the largest and most diversified financial services institutions in the United States.

The Obama administration?s proposal "is inconsistent with achieving" goals, such as promoting responsible lending, increasing jobs and promoting a stronger economy, said Steve Bartlett, president for the Financial Services Roundtable.

The group represents 100 top financial services firms providing banking, insurance, and investment products and services.

Obama's first year in office was dominated by efforts to rescue a handful of banks that threatened to topple the US economy after being exposed to massive losses on the subprime mortgage market.

According to Treasury officials, about 205 billion dollars was pumped into 707 banks under the government rescue plans.

Obama has sounded a tougher tone towards banks in recent weeks as he faced widespread voter anger at the massive government bailout, which came as Americans faced surging unemployment, home foreclosures and national debt.

Top Obama economic aide Austan Goolsbee sought to counter criticism that the plan is returning to the Depression-era law creating a wall between investment and commercial banks.

"It's not returning to Glass-Steagall," Goolsbee said.

While the act repealed in 1999 forbid underwriting securities or investing in securities by any commercial bank, Goolsbee said, "This is not that. This says a bank cannot own a hedge fund, cannot own a private equity fund or do trading for its own account that is not related to its client business."

He added that the goal is "to get back to the fundamental nature of the bank, which is serving its clients, rather than investing for its own profit."