Bitcoin, Ethereum, Litecoin, and Ripple are among the global cryptocurrencies used widely in Vietnam and have developed along with crypto business models, inevitably becoming assets, investment instruments, and means of fund raising in the SEA nation.

However, Vietnamese legal bodies have yet to recognize cryptocurrencies as legitimate means of payment, nor are they categorized as goods and services or properties and assets.

The absence of a legal framework for cryptocurrencies has proven to be complicated when handling tax collection, or frauds and scams through crypto-based transactions.

For instance, the first known court case related to cryptocurrencies in Vietnam was back in September 2013 between a businessman and the Tax Department of Ben Tre Province about the man’s alleged tax evasion. The court ruled in favor of the man due to the lack of a legal basis and the Department could not collect taxes from his crypto-based transactions.

In another case, the leader of a company called Modern Tech JSC in 2018 was accused of appropriating more than VND15,000 billion (about US$650 million) from people investing in iFan, Pincoins.

These examples show that blockchain technology and digital money are an irreversible trend based on scientific and technological achievements, therefore need an appropriate strategy and legal framework.

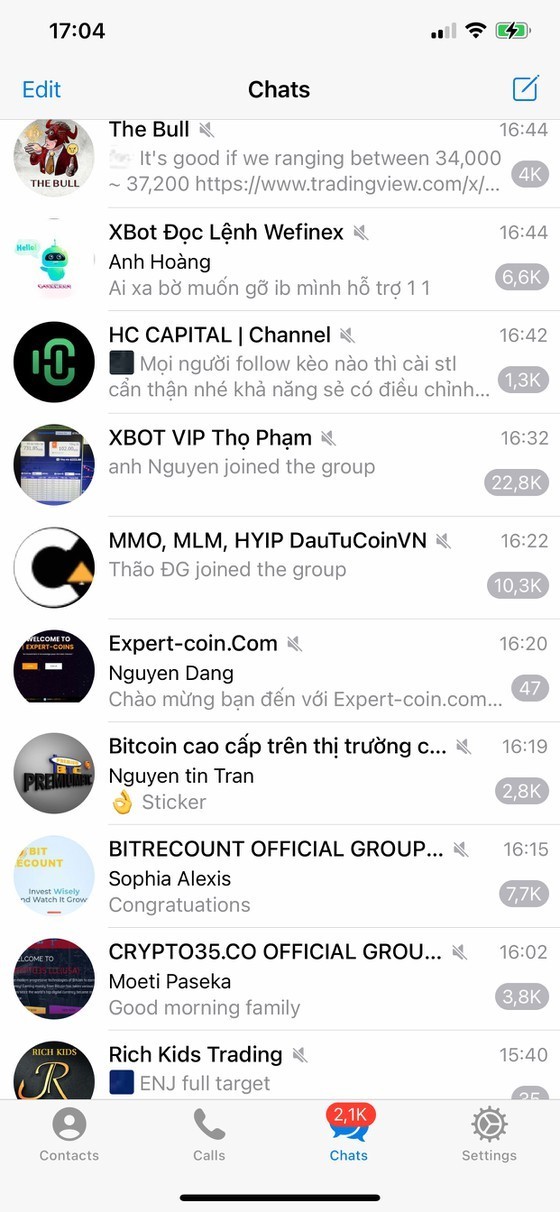

Online crypto-transaction forums

Online crypto-transaction forums

To quote an article on building a legal framework for financial technology development by PhD. Tran Hung Son of the University of Economics and Law in HCMC, the framework should ensure competent agencies can regulate transactions but still allow the application of related techs in the financial sector.

The article suggests to first classify cryptocurrencies according to their economic functions such as means of payment and exchange, investment instruments/securities, and utility tools. The classification would help determining suitable regulations for as well as the types of taxes to impose on them.

Plus, cryptocurrencies and traditional financial products with equal economic functions and risks should be subject to the same regulations to maintain the consistency of existing laws, the article states.

On the other hand, there should be specific policies that take into account established but “high risk” cryptocurrencies, while assessing the risk of other types based on their development. In addition, the construction of a framework should remain flexible and minimize administrative roadblocks.

Also, for the sake of prudent management, the related policies should take a neutral stance when dealing with specific technologies related to cryptocurrencies, while considering additional risks associated with their unique traits.

On a final note, the article lists recommendations from the Bank for International Settlements (BIS) and global pioneers in closely monitoring commercial banks in crypto-related activities to prevent risks from outside channels. Such activities include but not limited to the direct issuance or ownership of cryptocurrencies, loaning out cryptocurrencies, and using cryptocurrencies as collateral.

As of now, the Decree 80/2016/ND-CP on non-cash payments only acknowledges checks, payment orders, collection orders, bank cards and other means of payment recognized by the State Bank as legal means of payment.

Accordingly, the State Bank affirmed that it is illegal to use, save, or supply Bitcoin and other virtual currencies, and perpetrators will be fined up to VND200 million (about US$8,649). Similarly, causing financial damage to others by exploiting cryptocurrencies results in a fine of VND100-300 million (about US$4,326-12,979), or 6 months to 3 years in jail (Article 206 of the 2015 Penal Code, amended in 2017).