Vietnam's Trade Office in the UAE issued a stern warning urging Vietnamese exporters to exercise heightened caution when conducting business in the region on June 17. The Ministry of Industry and Trade also confirmed the alert.

One of the latest scams involves fraudsters creating "fake bank accounts" under real names. These individuals impersonate legitimate UAE-based companies, presenting seemingly authentic documentation—including trade licenses bearing official seals and verifiable office addresses listed on online maps. However, the designated payment accounts turn out to be newly opened personal accounts that are quickly emptied after receiving a deposit, leaving the Vietnamese exporters defrauded.

In another recent case, a fake escrow service posed as a major bank in Dubai. The scam website mimicked the actual bank’s online interface with convincing logos, layouts, and valid company registration details. Yet once the Vietnamese side transferred the deposit, the entire system vanished within 24 hours.

Beyond these newer tactics, long-standing schemes continue to ensnare Vietnamese businesses. Common ruses include receiving goods and fleeing, forging wire transfer slips, hacking emails to alter recipient bank account details, and colluding with bank staff to seize shipping documents.

Particularly alarming is a tactic dubbed “deliver-and-rot-at-port.” Here, buyers deliberately refuse to accept shipments of perishable goods like fresh fruits, seafood, and vegetables upon arrival at port. They delay clearance until the cargo spoils, then demand deep discounts or outright refuse the shipment, citing substandard quality. Several Vietnamese exporters have fallen victim to this ploy.

According to the Vietnam’s Trade Office in UAE, the most frequent victims are those using postpaid T/T (telegraphic transfer) or Western Union—payment methods that offer minimal recourse in cases of dispute.

To mitigate risk, businesses are advised against transacting with partners who only communicate via email, refuse video calls, or fail to provide verifiable office addresses. Vietnamese firms should prioritize transactions through major banks, use letters of credit (LCs), or rely on escrow services with traceable sources. First-time partners should always be vetted through the Vietnamese Trade Office or Embassy in the UAE.

Firms are also urged to rigorously verify any changes in bank account details via multiple channels, such as direct phone calls, digital signature validation, or requiring original stamped confirmation letters. Crucially, no payments or shipments should be made based solely on emails or scanned documents.

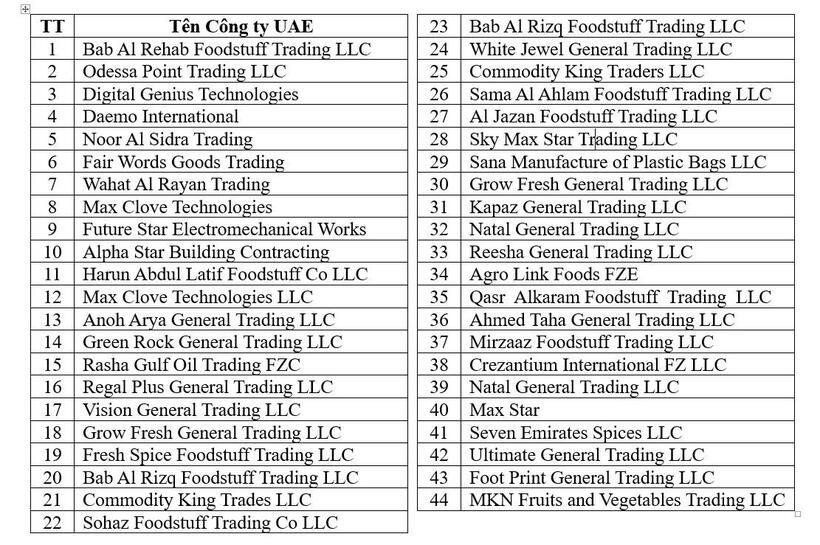

The Vietnam’s Trade Office in the UAE is currently tracking a list of suspicious entities and encourages Vietnamese businesses to consult with them directly before finalizing contracts or wiring payments.