Amid complicated developments of the China-United State trade war and gloomy global economic growth, the Vietnam’s economy was a highlight among emerging economies. Macroeconomic stabilizing achievements in the period of 2016-2017 continued to be maintained with high growth, inflation being controlled, stable exchange rate and increasing foreign exchange reserves thanks to effort to reform and improve investment environment.

Contributing to these successes, the financial system not only ensured its function to provide capital for the economy, support growth and effectively serve economic restructuring but also developed rapidly, healthily and securely.

By the end of 2018, total asset of financial institutions in Vietnam was roughly VND11.4 quadrillion, or 203 percent of gross domestic product. The role of non-bank financial institutions in financial system improved with growth of total assets of non-bank financial institutions reaching an average of 25 percent per annum in the period of 2016-2018, much higher than an average of 17 percent per annum in the period of 2014-2016.

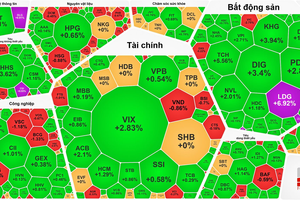

Contribution to capital supply for the economy from capital market has gradually increased. Market capitalization value compared to GDP climbed from 32 percent in 2015 to 75 percent in 2018, exceeding the plan for 2020. Corporate bond market size compared to GDP nearly doubled from 3.4 percent in 2015 to 6.7 percent in 2018. Similarly, government bond market compared to GDP also rose from 16.1 percent to 27 percent. Government bond value issued in 2018 nearly touched VND200 trillion, showing great potential in next years.

Capital market plays an irreplaceable in equitization and State capital divestment in State-owned enterprises. In the period of 2011 to 2018, there were more than 600 state-owned enterprises equitizing, fetching around VND200 trillion for the State budget. Business effectiveness and corporate governance quality of post-equitization state-owned enterprises have significantly improved.

As for private companies, capital market has created a flexible, direct and effective mobilization channel with capital from the society and from foreign investors. Private sector has seen firms with market capitalization of billion US dollars like Vingroup and Techcombank.

Besides achievements, financial market still faced the imbalance between monetary market and capital market, of which credit union system remained the leading role in financial system. Capital supply by banking sector accounted for a main proportion in total capital supply of the economy. Total assets of credit unions made up 96 percent of total assets of financial system. In the past years, commercial bank system has had to provide capital for the whole economy, thus it possibly creates maturity risk and liquidity risk in long term.

Although the stock market has improved in size, the capital into the real economic sector through initial public offering (IPO) is not large. The corporate bond market has not met standards of transparency. Corporate bond market size over GDP in Vietnam was just one third of average level of 21 percent of other Asian countries. Financial market infrastructure still has many shortcomings, such as financial products remained primitive and lack of diversity; the quality of information providing and market transparency was still poor; and legal framework for market operation has not completed. Total asset of financial system of the country merely reached 203 percent of GDP, much lower than those of top countries in the ASEAN which were above 300 percent of GDP.

Basic directions to develop financial market include developing modern monetary market and improving bank’s financial capacity. Some administrative instruments on monetary market should be removed, including ceiling of mobilizing rate and credit growth limit. Instruments and transaction approach, especially derivative instruments for exchange and interest rates, as well as participants on the monetary market should be diversified. The quality of information and payment infrastructure of the banking system should be improved via application of digital technology and financial technology.

In addition, commercial bank restructuring should be promoted. Financial infrastructure system should be established in order to deal with bad debts, in which debt market will be formed to improve credit supplying capacity to the real economy.

Effectiveness, competitiveness and financial capacity of commercial banks should be enhanced so as to ensure credit unions have sufficient capital requirements in accordance with Basel II guidelines. Risk management ability of commercial banks should be strengthened in accordance with international standards and common practices. Credit capital should be concentrated on local manufacturing and trading businesses, especially small and medium enterprises and firms in lucrative, productive and high-tech fields.

In order to develop capital market to become effective capital channel in medium and long terms and overcome the imbalance in capital providing structure, it is essential to develop corporate bond market. The scale of corporate bond market aims to be around 9 percent of GDP by 2020 and 20 percent of GDP by 2030.

A qualified credit rating organization and a corporate bond information center should be established. Corporate bonds making public offering must be rated.

It is necessary to promote the upgrading of the stock market to emerging market by gradually loosening control on capital transactions. By improving the convertibility of Vietnamese dong and flexible exchange rate mechanism, an offshore market for the Vietnamese dong can be built which will help to eliminate shortcomings of domestic foreign exchange market.