Starting from July 1, when the regulation of personal identification numbers officially replacing tax codes for individuals, households, and business households, the tax sector and banks in the former Binh Duong Province are making efforts to assist citizens and businesses in carrying out procedures to facilitate inquiries and reduce compliance costs.

According to information from the Tax Department of Region XVI in Binh Duong, to date, the tax sector has standardized the tax registration information of 2.4 million taxpayers, achieving a 96 percent match with the national population data from the Ministry of Public Security.

Tax codes issued before July 1, 2025, that match the national population data will not require any administrative procedures for taxpayers during the transition.

Taxpayers who have not registered for tax after July 1, 2025, will have their tax registration connected to the national population database to ensure accurate information verification.

During the transition, if the tax registration information does not match the personal information in the national population database, the tax authority will change the tax code status to 10 "tax code awaiting update of personal identification number". When the taxpayer engages in tax transactions with the tax authority, their personal identification information will be updated.

When registering for tax, an individual only needs to accurately declare three pieces of information including full name, date of birth, and personal identification number, ensuring they match the National Population Database. It is not necessary to submit a copy of their citizen identification card to the tax authority.

Starting from July 1, 2025, all personal identification numbers will be used in place of tax identification numbers in transactions with the tax authority. After this date, tax authorities will continue to review and standardize any information of tax identification numbers that do not align with the national database.

For business households and individual entrepreneurs with separate business locations, from July 1, 2025, the tax authority will no longer issue separate tax codes for each location. Instead, the household representative will use their unique personal identification number to fulfill tax obligations at the location where business activities occur. Previously issued location-specific tax identification numbers will be automatically converted to the corresponding personal identification number without requiring additional procedures.

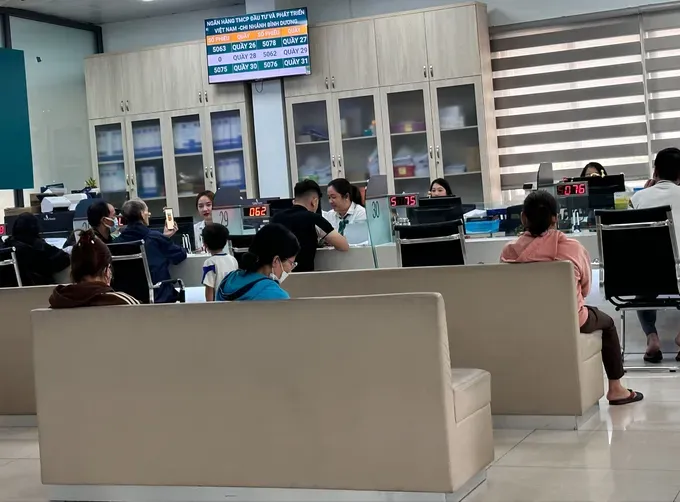

Director of BIDV - Binh Duong Branch Tran Ngoc Linh revealed that by July 1, they had supported 60 percent of their corporate customers in completing biometric authentication. The branch managers dispatched staff to each business to assist with this process, aiming to facilitate convenience for companies and provide specific step-by-step guidance as per regulations.