|

Some gas stations in Ho Chi Minh City just write retail invoices for customers |

Despite the Decree 123/2020/ND-CP on a mandatory deadline to complete the conversion from paper invoices to electronic invoices from July 1, 2022 and the Prime Minister’s recent telegram on the issuance of electronic invoices at petroleum retail stores, e-invoices still cannot be implemented.

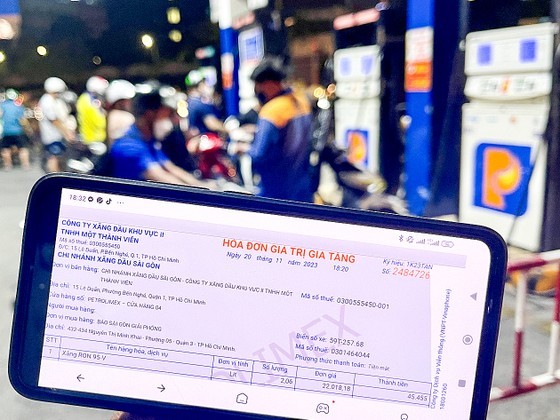

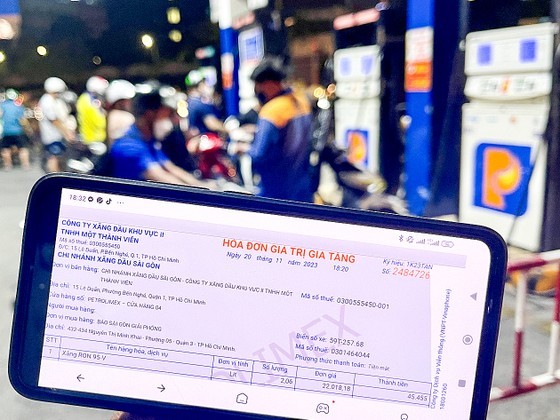

Some gas stations in Ho Chi Minh City issued electronic invoices whereas others did not on November 21, or some places wrote down retail invoices for customers.

At gas station No. 17 belonging to Can Gio Trading and Services Joint Stock Company on To Ky Street in District 12, a lot of customers were filling up their motorbikes’ tanks, but the seller did not remind them to take a receipt.

For some customers who want to receive an electronic invoice, the gas station staff will give them a retail invoice including a few lines of company address, phone number, gas price, and gas filling time as the gas station employee explained that the office staff in charge of billing returned home, no one is responsible for issuing receipts. Customers who want to receive electronic invoices can return to the gas station during office hours the next day.

According to a gas station staff, most customers do not care about electronic receipts. Those requiring an invoice usually fill up a lot of gas, mainly car drivers, with prices ranging from at least a few hundred thousand to several million Vietnamese dong.

Why gas stations did not issue electronic invoices to customers, a director of a petroleum business in Ho Chi Minh City said issuance of electronic invoices according to new regulations costs about VND800 for each invoice. About 1,000 customers buying gas a day will cost VND800,000 (US$32,904) in bills, not including other costs. If small businesses are forced to issue electronic invoices for all customers, they will not be able to survive but close down the station.

There are currently 546 existing gas stations in the city.

Mr. Truong Van Ba, Director of the Ho Chi Minh City Market Surveillance Department, said that the unit regularly coordinates with the Ho Chi Minh City Department of Industry and Trade and other departments to monitor and understand the situation of petroleum business activities in the area to promptly detect violation such as closing stations without reason, hoarding goods, trading fake, poor quality gasoline. However, according to Mr. Ba, the tax authority must be responsible for monitoring the issuance of electronic invoices to buyers.

According to the General Department of Taxation, cumulatively as of October 31, the tax agency has received and processed more than 5.6 billion invoices. However, the majority of agents and petroleum trading hubs have not yet had time to deploy this type of invoice, due to high investment costs and in a difficult business context.

Therefore, previously, the Ministry of Industry and Trade proposed to create a roadmap of 1-2 years so that agents have time to implement the new regulation. According to the Ministry, if the regulations of electronic invoice issuance and connecting electronic invoices with tax authorities, it will cause difficulties for businesses, cause supply interruptions, and negatively affect the supply of petroleum in the market.

However, recently, the Prime Minister issued an official dispatch requesting to strengthen the management and use of electronic invoices and promote digital transformation. Accordingly, it is necessary to immediately deploy appropriate, feasible and effective solutions to monitor the issuance and use of electronic invoices, especially the issuance of electronic invoices at petroleum retail stores for customers.

To support petroleum businesses converting to electronic invoices, and at the same time deter people from selling goods without issuing invoices, the General Department of Taxation on November 13 issued Official Dispatch No. 5080 requesting tax authorities in all localities to grasp the current status of implementing electronic invoices in local gasoline and oil stores. The General Department of Taxation has requested units to closely monitor the issuance and use of invoices for gasoline and oil, thereby detecting and strictly handling acts of issuing and using invoices and documents illegally.