According to Business Monitor International (BMI), although the confectionery industry's growth has slowed down to 5- 8 percent in the period from 2015 to 2020, the revenue scale of this sector is still increasing quickly.

Specifically, in 2013, the revenue of the whole industry merely reached about VND26 trillion, then in 2017, it increased to VND40 trillion. And in 2020, BMI also forecasts that the revenue will be about VND51 trillion (US$2.2 billion). Especially, the scale of the confectionery industry is forecasted to continue to increase, as the population of Vietnam is large and young, with consumption of confectionery per capita of just over 2 kilograms per person per year, lower than the level of 3 kilograms per person per year of the world.

This is understandable when in early June, KIDO Group announced its return to the confectionery sector after five years of transferring to its foreign partner. According to the representative of KIDO, the confectionery industry is the advantage of the Group, so when it returns to this sector, the company will choose the product segments with great demand, and it is confident to make profits this year.

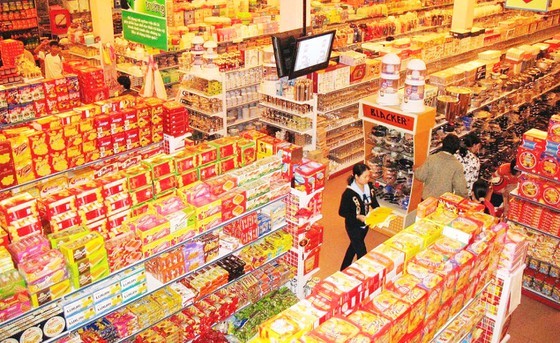

Along with KIDO, the Vietnamese confectionery market has seen the participation and domination of some domestic enterprises, including Bibica, Huu Nghi, Pham Nguyen, Hai Ha, Trang An, Hai Chau, Biscafun, and Hanobaco. Besides, there have been foreign brands, such as Kraft (USA), Orion Food Vina, Meiji (Japan), Perfetti Van Melle, Liwayway / Oishi, and Lotte (Korea).

Although it is a potential market, according to market research units, competition in the confectionery market is increasingly cutthroat because Vietnamese consumers' behavior has recently changed. Specifically, due to the influence of the Covid-19 pandemic, the consumption and spending habits of consumers have changed a lot. Not to mention that recently, the EU-Vietnam Free Trade Agreement (EVFTA) officially came into effect, expecting to create momentum for sweetmeats from Europe to flow into Vietnam, directly competing with domestic products.

Moreover, with the development of technology, consumers are conferring themselves in choosing products when most of them find out information about products before going shopping. The above changes have forced enterprises in the confectionery industry to have appropriate strategies and steps to stand firmly on the home ground.

Amid the above changes, many confectionery enterprises said that they had to adjust to match this trend. For instance, Bibica has oriented that it will focus on developing eco-friendly product designs and packaging, suitable for display regardless of any space in the coming time. This aims to help the company's products to be recognized more easily by customers. Meanwhile, KIDO said that instead of diversifying the product category, it would select, research, and produce product groups with high demand, large market scale, and immediate effect.

Besides the above strategies, confectionery companies said they would promote communication, discount, and support for distributors, as well as regularly launch new products. Because a confectionery product, when being released, besides the quality criteria, must also meet the diverse needs of a family at different times. Or, the product can use for a wide range of customers. For example, the elderly need to use less sweet and easy-to-digest products.

In fact, the aforesaid changes by confectionery companies have been highly appreciated by domestic consumers. Ms. Nguyen Mai Linh, a resident in District 7 in Ho Chi Minh City, shared that in comparison with three years ago, the types of sweetmeats in the country are now more and more plentiful, diverse, and eye-catching. In terms of quality and prices, domestic sweetmeats are also gradually narrowing the gap with those of foreign ones. The prices of many types of domestic confectionery are even cheaper than those of foreign counterparts, but the quality is not inferior.