According to Matthew Glitzer, Vice President of IBM Security – Asia Pacific, people have a tendency to gradually changing from offline to online activities. Since online shopping becomes a new fashion, cyber security is more and more vital to any business. Therefore, in order to optimize the highest security level, businesses and organizations need to apply and adapt to the Zero Trust architecture.

This security model suppose that any device is not to be trusted by default. It continuously advocates mutual authentication, including checking the connection conditions, data, and resources to identify the authentication and demand of personal information.

In the last two years, in Southeast Asia, Vietnam has been one of the most targeted nations of hackers for bitcoin mining (accounting for 80 percent and 71 percent of the total cyber attackers in the region in 2019 and 2020 respectively).

Kaspersky has warned any businesses experiencing an abnormal rise of electricity bill, even when their staff is working from home, that they may be the victim of bitcoin mining.

Information leaks are also a thorny issue at present, especially when people become gradually dependent on the online platform of a third party, leading to a higher potential risk. When obtaining confidential information, hackers are able to fake victims’ identity or trick them to reveal more sensitive login data.

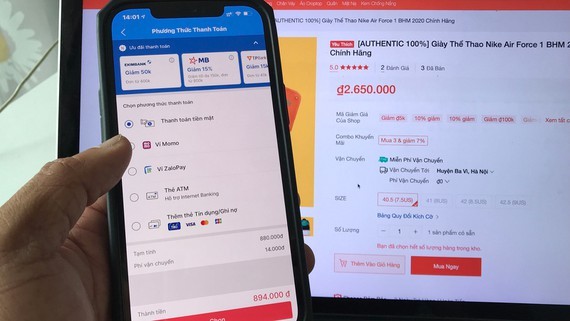

Cashless transactions are wholeheartedly encouraged in Vietnam to avoid close contact during Covid-19 pandemic. Statistics reveal that 85 percent of Internet users at least own one electronic wallet or install a payment app. Over 42 percent of them are making contactless payment via a mobile device.

Obviously, these people are ideal targets of cyber criminals, who love to attack Internet banking users. Those attacks are forecast to be on the rise in the near future. Hence, smart device owners need to be fully aware of the risks in a digital society and implement proper prevention methods.

Experts in the field warn that Internet users should be careful with announcements of discounts and coupon exchange. Financial organizations and sales agencies will never send a text message asking them to update their account information or confirm their ATM card number. This can only be from scammers.

Kaspersky firmly believe that the Vietnamese Government has done a good job in both fostering cashless transactions and raising the public awareness about the dangers of information stealing as well as implementing suitable methods to fight against cyber criminals. With proper habits of network using, the Vietnamese are able to protect their own information on the online environment.