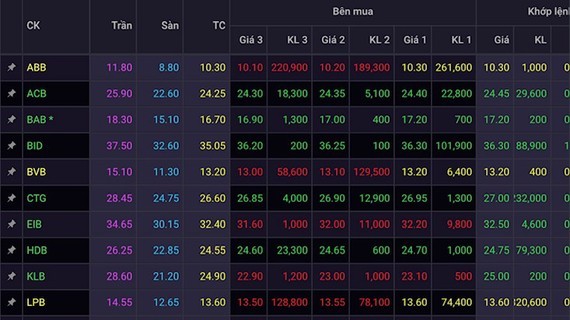

From the beginning of the trading session, financial stocks, such as banks and securities, gained positively, keeping the VN-Index from falling sharply even though many sectors were flooded in the red.

Banking stocks that climbed the most on the floor at approximately 3 percent were VIB, BID, TCB, CTG, and MBB. Securities stocks, like VCI, HCM, and VND, also remained in an upward trend. Besides, penny-chip stocks, like HAG, AMD, ITA, and HNG, and steel stocks, including HPG, HSG, and NKG, also went up because of vibrant trading.

In contrast, energy and seafood stocks dropped sharply. Specifically, VHC declined by 4.2 percent, ACL retreated by 5.1 percent, NT2 sank by 5.6 percent, VSH slumped by 4.9 percent, and REE slid by 3.5 percent. As a result, the market still dropped slightly.

Closing the morning session, the VN-Index deleted 4.5 points, or 0.38 percent, to 1,191.03 points. On the Hanoi Stock Exchange, the HNX-Index also went down by 2.04 points, or 0.73 percent, to 279.15 points.

In the second half of the afternoon trading session, the market continued to be caught in a tug-of-war, and the VN-Index sometimes slightly edged up. However, towards the end of the trading session, the selling pressure increased in several stock groups, causing the VN-Index to plunge deeply from the 1,190-point mark. Foreign investors also net sold about VND270 billion on the HoSE. Although the banking group still maintained good rising momentum in the market, with BID up 3.6 percent, STB up 3.1 percent, TCB up 3.9 percent, CTG up 1.5 percent, and VPB up 1 percent. However, the strong selling pressure in other stock groups made the group of king stock unable to withstand it.

The strong selling demand caused many energy stocks to fall steeply. Specifically, REE and GEX hit the floor; GAS dived by 5.2 percent; PVS cut 3.2 percent; POW reduced by 3.7 percent; PC1 slashed 6.62 percent. Securities stocks, such as VCI, HCM, VND, and SHS, also receded to below the reference prices. In addition, MWG lost 3.4 percent, MSN chopped 5.3 percent, and PNJ curtailed 4.2 percent. Therefore, the VN-Index closed at the lowest price of the trading session.

At the end of the trading session, the VN-Index plummeted 14.24 points, or 1.19 percent, to 1,181.29 points, with 120 gainers, 347 losers, and 48 unchanged stocks. The HNX-Index fell by 3.25 points, or 1.16 percent, to 277.94 points, with 54 gainers, 159 losers, and 45 unchanged stocks.

Market liquidity improved, increasing by nearly 38 percent compared to the previous session, with total trading value reaching VND14.1 trillion.

Banking stocks that climbed the most on the floor at approximately 3 percent were VIB, BID, TCB, CTG, and MBB. Securities stocks, like VCI, HCM, and VND, also remained in an upward trend. Besides, penny-chip stocks, like HAG, AMD, ITA, and HNG, and steel stocks, including HPG, HSG, and NKG, also went up because of vibrant trading.

In contrast, energy and seafood stocks dropped sharply. Specifically, VHC declined by 4.2 percent, ACL retreated by 5.1 percent, NT2 sank by 5.6 percent, VSH slumped by 4.9 percent, and REE slid by 3.5 percent. As a result, the market still dropped slightly.

Closing the morning session, the VN-Index deleted 4.5 points, or 0.38 percent, to 1,191.03 points. On the Hanoi Stock Exchange, the HNX-Index also went down by 2.04 points, or 0.73 percent, to 279.15 points.

In the second half of the afternoon trading session, the market continued to be caught in a tug-of-war, and the VN-Index sometimes slightly edged up. However, towards the end of the trading session, the selling pressure increased in several stock groups, causing the VN-Index to plunge deeply from the 1,190-point mark. Foreign investors also net sold about VND270 billion on the HoSE. Although the banking group still maintained good rising momentum in the market, with BID up 3.6 percent, STB up 3.1 percent, TCB up 3.9 percent, CTG up 1.5 percent, and VPB up 1 percent. However, the strong selling pressure in other stock groups made the group of king stock unable to withstand it.

The strong selling demand caused many energy stocks to fall steeply. Specifically, REE and GEX hit the floor; GAS dived by 5.2 percent; PVS cut 3.2 percent; POW reduced by 3.7 percent; PC1 slashed 6.62 percent. Securities stocks, such as VCI, HCM, VND, and SHS, also receded to below the reference prices. In addition, MWG lost 3.4 percent, MSN chopped 5.3 percent, and PNJ curtailed 4.2 percent. Therefore, the VN-Index closed at the lowest price of the trading session.

At the end of the trading session, the VN-Index plummeted 14.24 points, or 1.19 percent, to 1,181.29 points, with 120 gainers, 347 losers, and 48 unchanged stocks. The HNX-Index fell by 3.25 points, or 1.16 percent, to 277.94 points, with 54 gainers, 159 losers, and 45 unchanged stocks.

Market liquidity improved, increasing by nearly 38 percent compared to the previous session, with total trading value reaching VND14.1 trillion.