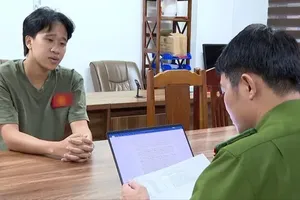

On April 24, 2024, the Police of District 4 prosecuted Do Minh Hai and his four accomplices for ‘Lending money with high interest rates in civil transactions’.

Investigation results reveal that Hai operated TM 24H Co. and ATM Online Co., both of which were sited at the address of 261-263 Phan Xich Long Street of Phu Nhuan District. Hai hired two people to take the position of company directors and delivered detailed instructions to each person. Registered as a business for financial consultation and pawning activities, these two companies used high technologies to offer loans online.

Hai and his group made mortgage loan contracts, consultation contracts, and bogus asset mortgage contracts to divide real loan interest rates into the basic rate of less than 20 percent a year, consultation fees, service fees, and asset mortgage fees, all of which add up to over 80 percent a year. They had been able to disburse nearly VND4 trillion ($157.2 million) in 738,000 contracts, earning an amount of VND4.7 trillion ($184.66 million).

Current ‘black credit’ activities are increasingly more cunning, creating challenges to functional agencies in investigating and handling. Many of these organizations have switched from advertising their services via flyers to inviting people to install their own apps via social network sites. They list several kinds of service fees for the loaned money.

This has trapped a large number of needy people as they did not think the interest rate could come to 2.5 – 5 percent a day, or even an incredible 900 – 2,000 percent per year. Debtors without the ability to pay back money would then have their profile sent to specialized debt collectors, severely affecting their reputation.

This new type of ‘black credit’ aims at people using the Internet and smart devices who have a desire to borrow money without any asset for mortgage or are not entitled to formally loan money from banks and prestigious credit organizations. They are mostly poor laborers in industrial parks and export processing zones, small traders.

People in ‘black credit’ organizations normally advertise their services on social network platforms such as Facebook, Zalo, or TikTok. They also use a hotline to seek people in need of finance. Potential customers are consulted about interest rates, loan time, payment methods, and service fees. More importantly, they are lured by the detail of no asset mortgage needed for any loan. All they need is a copy of their citizen ID card, personal sensitive or confidential pictures.

These ‘black credit’ groups work illegally in private groups without transparency, many of which are related to foreigners and take full advantage of available technologies to track money borrowers or to carry out loaning procedures online.

The HCMC Police warns that under no circumstances should citizens contact or make transactions with these ill-intention people. Moreover, people should report to the police any information related to these dangerous organizations (website addresses, phone numbers, threatening behaviors).

If people are falsely asked by debt collectors to pay money, they should record the calls or save the messages as evidence when reporting to the police. When using social network websites, Internet users should be careful to protect their own confidential data to minimize the ability of ill-intention groups using it for scamming purposes.

Facilities providing photocopy services should refuse serving ‘black credit’ organizations or report them to the police. Any people in need of finance should contact formal loan sources such as banks, credit foundations, union foundations for safe money loaning, along with suitable preferential policies.

It is not advisable to come to apps with unclear origin or informal websites to borrow money and later be forced into enduring harassing behaviors or even illegal acts of debt collectors.

Deputy Director Mai Hoang of the HCMC Department of Public Security informed that crimes related to ‘black credit’ are becoming more cunning and complicated. In 2023, the city police detected and handled 404 subjects in 263 such cases. In the first quarter of this year, another 115 subjects in 63 cases were discovered and punished.

Most of them are structured as hi-tech loaning businesses that lend money via apps with unacceptably high interest rates of up to 900 percent a year. Several have been reported to use weapons to collect debt. A total of 27 such apps were detected and eliminated, including Goldvay, sugarvay, findong, wellvay, cfcash, baovay.