The vice chairman made the statement at this morning’s seminar ‘Green transformation: From pressure to business opportunities" organized by Nguoi Lao Dong Newspaper.

Approximately 90 percent of Vietnamese businesses are small and medium-sized enterprises (SMEs). However, it is primarily large corporations that have taken significant steps toward green transformations. SMEs, on the other hand, are encountering numerous challenges in the green transformation process, with financial issues being one of the major barriers.

According to HUBA Vice President Dinh Hong Ky, although the green transformation trend is growing strongly, there are still many challenges for consideration.

Small and medium-sized enterprises (SMEs) constitute approximately 90 percent of the business landscape in Vietnam. However, the majority of companies actively pursuing green transformation initiatives are large corporations. SMEs encounter a range of obstacles in their greening efforts, spanning financial limitations, human resource constraints, access to appropriate technologies, and a general lack of awareness regarding sustainable practices.

Statistical data indicates that approximately 65 percent of businesses experience difficulties in securing the necessary capital to implement environmentally sustainable projects. While financial support mechanisms are available, ensuring that these resources reach the appropriate recipients presents a considerable challenge. Furthermore, human resource constraints represent a worrisome factor in the successful execution of green initiatives.

According to Mr. Ky, a mere 12 percent of businesses in Ho Chi Minh City possess a team of personnel with expertise in ESG (Environment, Society and Governance), posing a significant obstacle to the transformation process.

In response to these challenges, HUBA representatives urged the Government and management agencies to provide solutions that would support businesses in implementing green transformations. A comprehensive strategy focused on improving access to capital for green initiatives, providing targeted training programs for human resources, and fostering a culture of technological innovation will be essential in helping Vietnamese businesses not only meet increasingly stringent green standards but also significantly enhance their competitiveness in the global economy.

The State Bank of Vietnam (SBV) representative in Ho Chi Minh City stated that the banking industry has long viewed green transformation as part of its sustainable development strategy. Since 2015, the SBV Governor has initiated a project to develop green banking in Vietnam, even before the 2020 Law on Environmental Protection came into effect. This law also tasked the banking industry with issuing guidelines for environmental risk management in credit granting activities.

By August 2024, the SBV had issued a decision to amend the green banking development project, specifying more specific tasks and assigning clear responsibilities to each functional unit. The increasing demand for green capital presents a significant opportunity for businesses. However, realizing this potential requires businesses to invest in improving their internal capacity, adopt environmentally sound practices, and demonstrate a commitment to sustainability that aligns with international standards.

One of the major challenges today is the mismatch between the financial needs for renewable energy projects and bank capital. Banks primarily provide short-term capital whereas green projects typically need medium- to long-term funding, straining the credit system.

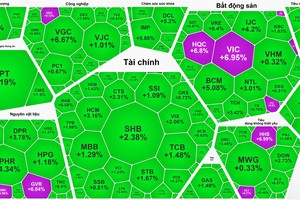

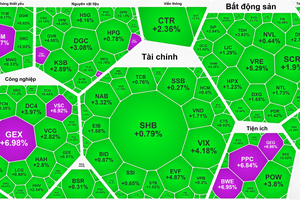

In order to alleviate pressure on banks, the Ministry of Finance and the State Securities Commission are focusing on mobilizing capital through the stock market and other financial channels. This strategy will play a crucial role in providing renewable energy projects with more sustainable capital sources, said a representative from the State Bank of Vietnam's Ho Chi Minh City branch.

Director Vuong Thanh Long of BIDV's Capital and Monetary Economics Department said that the bank recognizes green transformation as both a challenge and an opportunity.

Being a leader of the largest credit institution providing green credit in the industry, Mr. Long also acknowledged business need large capital for modernizing technology during the green transformation process.

Despite the evident benefits of green transformation, companies continue to encounter challenges in securing funding, implementing emission measurement technologies, and adhering to environmental monitoring regulations.

Mr. Long revealed that by the end of 2024, BIDV's green credit reached approximately VND81,000 billion. Currently, the bank is actively implementing policies to gradually reduce funding for industries with high carbon emissions such as iron and steel, cement, and fertilizer, while increasing support for green projects with incentives on interest rates and exchange rates. BIDV has also issued a list of green projects and identified priority capital levels for businesses that meet sustainability standards.

Mr. Long suggested that to accelerate the green transition in the financial system, the Government and regulatory agencies should promptly issue a list of green projects along with specific standards and conditions. This would provide businesses and banks with a clear framework for accessing capital. Once the list is published, the Government could allocate part of the budget to refinance banks, creating incentives to lower interest rates and lending fees for green projects.

Head Lim Dyi Chang of Corporate Banking at UOB Vietnam, stated that the bank is currently offering green loans with more favorable terms than traditional loans. These loans can feature higher financing rates of up to 70 percent for projects that meet international sustainability standards, making it easier for businesses to access capital and accelerating the green transformation process.

The bank not only provides project financing but also offers working capital for green initiatives, fostering an environment that enables businesses to grow in sustainable sectors.

UOB is implementing many solutions to promote green credit and support Vietnamese businesses in the process of sustainable development. This effort not only helps businesses access preferential loans to implement green projects but also contributes to the Government's commitment to reduce greenhouse gas emissions to zero (Netzero) by 2050, said Mr. Lim Dyi Chang.