|

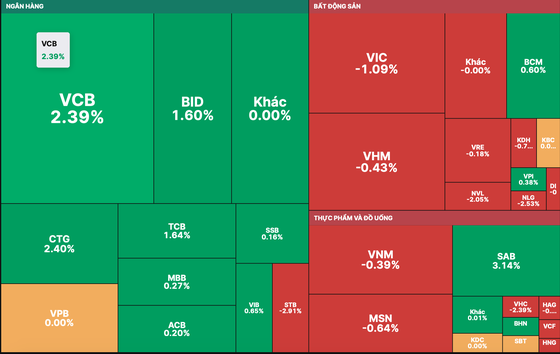

Vietnam’s stock market opened the morning session with several stocks in many sectors dropping, including real estate stocks that fell sharply. VCB carried the market with an increase of nearly 4 percent, helping to keep the VN-Index up slightly at the end of the morning session.

In the afternoon session, the market shook strongly due to high supply. The VN-Index sometimes nosedived to near 1,060 points, but then the cash flow entered, and three stock groups that attracted cash flow to turn to gain strongly included banking, securities, and steel.

Specifically, HSG hit the ceiling. Although HPG and NKG failed to keep the maximum allowed daily increase, they also jumped by 5.57 percent and 6.56 percent, respectively. TLH enlarged by 5.3 percent. The banking stock group also rallied robustly, contributing largely to the VN-Index's gain, with VCB up 2.39 percent, BID up 1.6 percent, CTG up 2.4 percent, TCB up 1.64 percent, and HDB up 1.67 percent.

Noticeably, the real estate credit conference organized by the State Bank of Vietnam on February 8 to discuss solutions for the real estate market was expected by investors to have an open door for this market. However, the results of the meeting did not provide any specific solutions, causing many real estate stocks to plunge again.

Specifically, NVL went down 2.05 percent, NLG declined by 2.53 percent, DXG slid by 1.57 percent, PDR sank by 3.52 percent, KHG decreased by 2.56 percent, HDG shrank 1.54 percent, VIC weakened 1.09 percent, and VHM reduced by 0.43 percent.

The VN-Index gained 6.38 points, or 0.6 percent, to close at 1,072.22 points, with 210 winners, 188 losers, and 67 unchanged stocks. Closing the session in Hanoi, the HNX-Index edged up 0.62 points, 0.29 percent, to 210.62 points, with 92 advancers and 69 decliners.

Market liquidity was low, with the total trading value on the two trading floors less than VND10.9 trillion.

Foreign investors still bought stocks with a net value of VND400 billion on the HoSE and the HNX.