A series of stocks such as C.E.O Group JSC (CEO), Dat Xanh Group (DXG), Hoa Bình Construction and Real Estate Corporation (HBC), Tan Tao Investment and Industry Corporation (ITA), Hoang Quan Consulting-Trading-Service Real Estate Corporation (HQC), LDG Investment JSC (LDG), Development Investment Construction Company (DIG) hit the ceiling price. However, the group of stocks of the FLC family, in which FLC and ROS shares have not been rescued but fell to the floor and had a surplus of tens of millions of shares at the floor price.

At the end of the session, VN-Index increased 22.51 points to 1,465.3 points with 368 stock gainers, 109 losers, and 32 unchanged. Closing the session on HNX, HNX-Index increased 2.49 points to 411.8 points with 193 gainers, 60 losers, and 30 unchanged.

Market liquidity increased by about 30 percent compared to the previous session with a total matching value of VND24,110 billion.

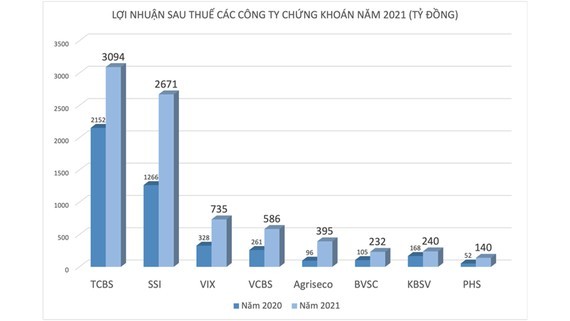

Specifically, SSI Securities Company has just announced that the consolidated profit before tax for the year 2021 is estimated at VND 3,350 billion, far exceeding the plan of VND1,870 billion and more than double that of 2020.

Viet Dragon Securities (VDS) also revealed that the total revenue of the parent company reached VND 1,039 billion, exceeding 97 percent of the 2021 plan and growing by 123 percent compared to 2020.

Deducting expenses, VDS recorded a pre-tax profit of VND 534.9 billion, an increase of 297 percent of the 2021 plan and an increase of 185 percent against 2020.

Agriseco Securities Company (AGR) also said that after deduction of all expenses, the company’s profit after tax in 2021 reached nearly VND79 billion, up 5 times compared to the same period in 2020.

KB Securities Vietnam (KBSV) also reported a profit after tax of VND 66 billion, an increase of more than 24 percent over the same period in 2020. Technological and Commercial Securities Company (TCBS) also reported that pre-tax profit reached VND963 billion, up by 73 percent over the same period last year…

The majority of profits of securities companies come from brokerage revenue, margin lending, and revenue from investment products.