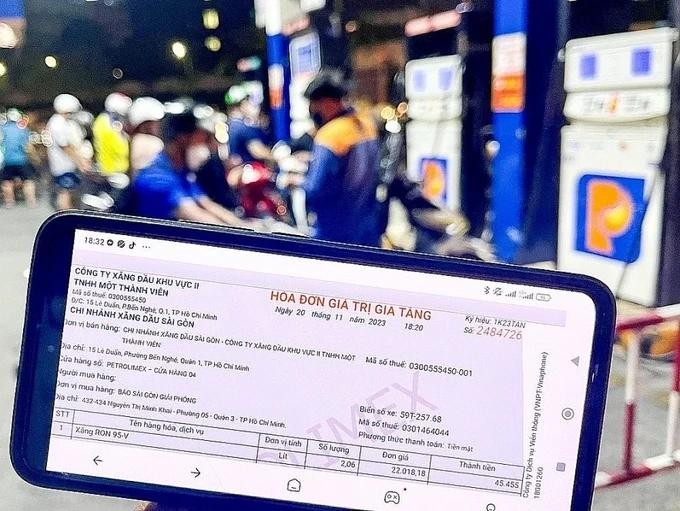

According to the Tax Department, many petroleum stores persist in utilizing manual data entry for each sale to generate electronic invoices, which can result in incomplete and inaccurate records.

The HCMC Tax Department has recently released a notice outlining new regulations for the issuance of electronic invoices at petroleum retail stores. It recommended that petroleum retail stores in the area switch to automatic data connection solutions to issue electronic invoices for each sale.

The Tax Department has reported that, despite extensive promotion through various channels, numerous retail gasoline outlets continue to manually input information for each transaction in order to generate electronic invoices. This process relies solely on the seller's data entry, resulting in incomplete electronic invoices for individual sales.

This department highlighted that the method for linking sales data is automatically relayed for every transaction, from the fuel measurement column to the management system. This process, which relies on an Internet connection for data storage, facilitates the issuance of electronic invoices for each sale and the transmission of invoice information to the tax authority, thereby mitigating errors and preventing incomplete data entry.

The Ho Chi Minh City Tax Department also emphasized that gasoline businesses must clearly understand and fully recognize the responsibility to implement the regulations on creating electronic invoices for each sale as prescribed in the Government’s Decree No. 123/2020.

The Tax Department has announced its involvement in the inter-sectoral inspection team focused on petroleum within the region, as outlined in Decision No. 1494 issued by the Ho Chi Minh City People's Committee. During the inspection process, the inter-sectoral team will analyze the data from the petroleum measuring column in conjunction with the sales invoices provided by petroleum businesses and retail stores.

Petroleum businesses that contravene e-invoice regulations, such as the failure to issue electronic invoices, the issuance of inaccurate or untimely invoices, or the delayed transmission of electronic invoice data, will be subject to penalties as prescribed by law.

To prevent instances of selling products without the issuance of electronic invoices, as well as the premature or delayed issuance of these invoices and the subsequent transfer of electronic data to tax authorities, the Ho Chi Minh City Tax Department advised petroleum retail establishments in the region to adopt automated data connection solutions for the issuance of electronic invoices for each transaction. Therefore, it helps minimize human impact contributing to the prevention of fraud in the retail business of gasoline and oil.

To address any challenges or difficulties encountered by petroleum businesses, the Ho Chi Minh City Tax Department recommends that these entities seek assistance from the tax authority and the relevant departments, including the Department of Science and Technology and the Department of Standards, Metrology, and Quality.

In a regular government meeting held in February 2024, Prime Minister Pham Minh Chinh emphasized that gasoline stations must comply with the mandate to implement electronic invoicing by March 2024, failing which their licenses would be revoked.