Some businesses raised their prices by up to VND2.45 million per tael, causing the price of gold rings to soar beyond VND71 million per tael. Meanwhile, SJC gold still hovered around the peak price of VND82 million per tael.

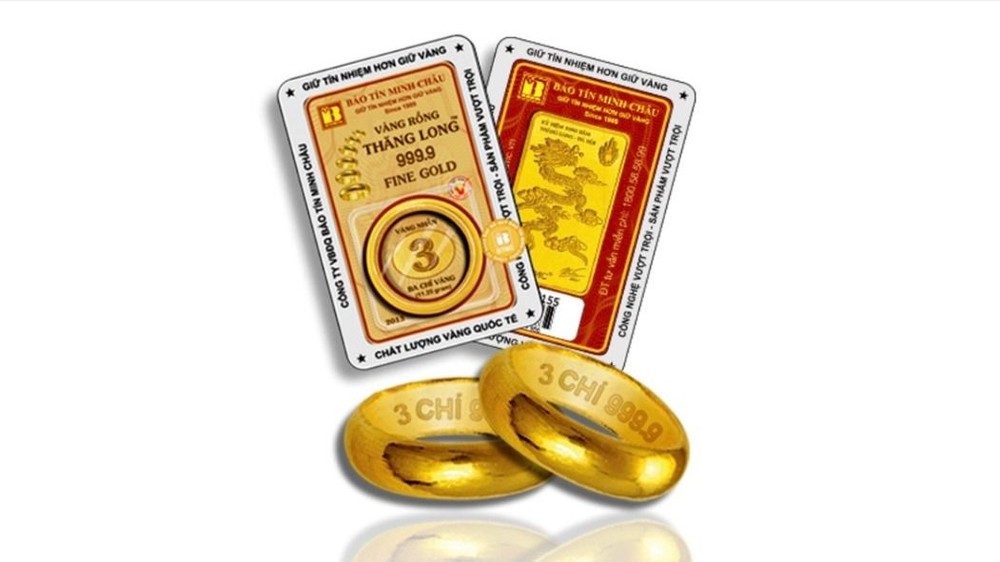

Around 9:30 a.m., Bao Tin Minh Chau Company increased the price of 9999 gold rings by an additional VND1.25 million for buying and VND2.45 million for selling compared to last weekend, sending the buying price to VND69.98 million per tael and the selling price to VND71.28 million per tael.

This enterprise currently leads the market in trading 9999 gold rings at the highest prices. Its rates surpass those of other businesses by up to VND1.3 million per tael and exceed the global gold price by VND6.1 million per tael, up from the gap of VND4.6 million last weekend. This company has now established the highest price for 9999 gold rings, up to now.

SJC Company also raised the price of 9999 gold rings by an additional VND400,000 for both buying and selling rates compared to last weekend, reaching VND68.8 million per tael for purchases and VND70.05 million per tael for sales.

Although the price of SJC gold remained relatively stable, it continued to hover around VND82 million per tael. Specifically, SJC Company listed SJC gold at VND80 million per tael for buying and VND82 million per tael for selling, an increase of VND500,000 in the buying rate. PNJ Company bought gold at VND80 million per tael and sold it at VND82 million per tael, unchanged from the previous weekend.

In the global gold market, the spot gold price on the Kitco exchange stood at US$1,278.2 an ounce on the morning of March 11 (Vietnam time), marking a decrease of approximately $1 compared to the previous weekend's closing price. This translates to roughly VND65.2 million per tael after conversion, which is lower than the price of SJC gold by about VND16.8 million per tael and lower than that of 9999 gold rings by about VND4.9 - 6.1 million per tael.

Throughout the past week, the global gold price has sustained its upward trajectory, consistently reaching new peaks. This surge has been buoyed by several key factors, including negative economic indicators from the US, a rise in US unemployment rates, and remarks from Federal Reserve Chairman Jerome Powell during his testimony before the US Congress.

Investors are increasingly hopeful that the Fed might initiate monetary policy changes sooner than expected. Analysts suggest that gold has witnessed significant gains over the week and may continue its upward trend as central banks and investors alike turn to gold as a safe haven asset.