Valuable resource

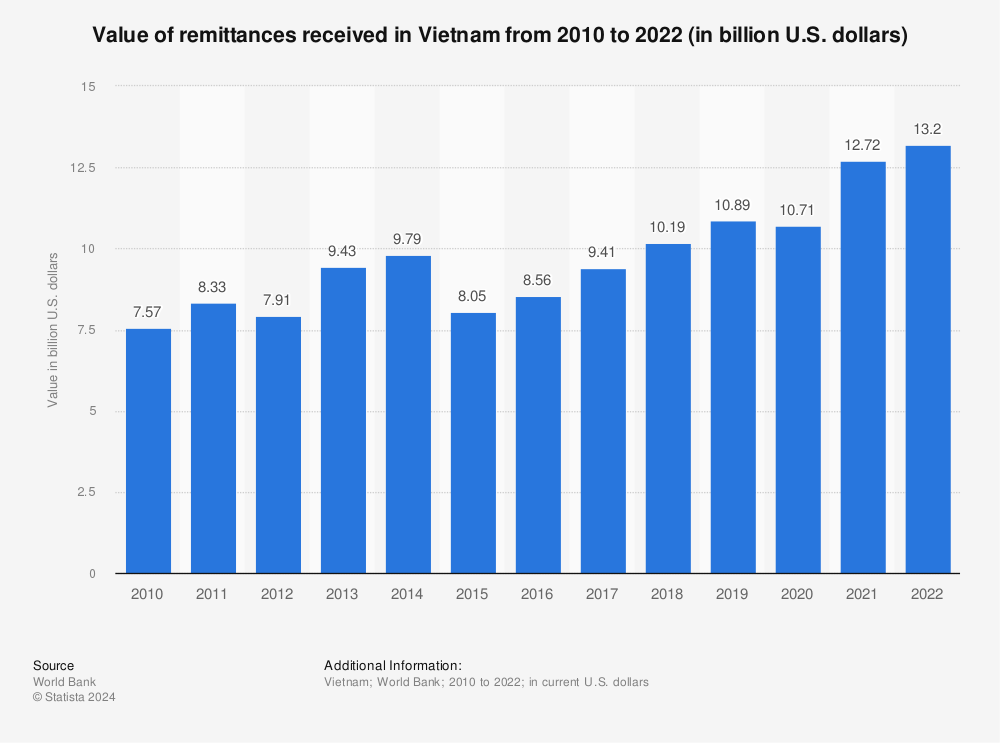

According to data from the State Committee for Overseas Vietnamese, remittances to Vietnam from 1993 to the end of 2022 totaled over $190 billion, nearly matching the disbursement of Foreign Direct Investment (FDI) during that period. When considering 2023, the cumulative amount reached approximately $206 billion. In 2023, the State Bank of Vietnam's Foreign Exchange Management Department reported that remittances flowing into Vietnam were estimated to be around $16 billion, up 32 percent compared to 2022.

Mr. Nguyen Duc Lenh, Deputy Director of the SBV- Ho Chi Minh City Branch, noted that despite the global economic downturn, inflation, and armed conflicts impacting economic growth and factors related to remittances, remittances to HCMC still reached $9.46 billion in 2023, up 43.3 percent compared to 2022. This marks the highest growth rate in the past ten years and accounts for nearly 60 percent of the total remittance volume nationwide. Remittances to HCMC over the past year were 2.7 times the total FDI capital into HCMC and approximately 14 percent of HCMC's Gross Regional Domestic Product (GRDP). Lenh expects remittances to HCMC to increase by about 20 percent in 2024.

While FDI can potentially have adverse environmental impacts, and Official Development Assistance (ODA) often entails stringent conditions and future repayment burdens, remittances represent a unidirectional flow of funds, exerting no pressure for repayment or other issues. For HCMC, remittances consistently maintain a stable growth rate averaging between 3 percent and 7 percent per year.

In 2022, remittances to the city totaled $6.6 billion (nearly VND157 trillion), surpassing FDI by more than 1.5 times and equating to one-third of the city's total annual budget revenue. In 2023, remittances amounted to $9.46 billion (nearly VND233 trillion), almost tripling FDI ($3.4 billion) and accounting for half of the total annual budget revenue (VND439 trillion). Compared to the 5.81 percent growth rate of HCMC's GRDP in 2023, the 35 percent growth rate of remittances is highly impressive, serving as an immensely valuable resource for socio-economic development.

Primarily into real estate

Regardless of whether remittances are utilized for investment in expanding production, business ventures, or personal savings, they all serve as positive resources for socio-economic development.

Mr. Nguyen Duc Lenh noted that while the SBV has no specific statistics on the destinations of remittances, this foreign currency flows into the economy for purposes such as consumption, business activities, enhancing living standards, and constructing homes, bringing numerous benefits to the economy and social welfare. The utilization, expenditure, investment, and business endeavors fueled by remittances yield significantly different and more efficient outcomes compared to other sources of foreign currency in terms of usage costs and conditions.

According to Dr. Can Van Luc, Member of the National Financial and Monetary Policy Advisory Council, the annual remittance inflow to Vietnam is a valuable resource and a crucial support for the economy. A large portion of these funds is directed towards investments in the real estate sector, followed by consumption, assistance to relatives within the country, and investment purposes.

Meanwhile, statistics from the Central Institute for Economic Management indicate that approximately 15-20 percent of remittances sent to Vietnam are directly invested in real estate. According to financial expert Nguyen Tri Hieu, in HCMC, over 50 percent of remittances are currently channeled into real estate, either directly or through acquaintances, while the rest is used for consumption or to support family members.

Remittances to Vietnam primarily flow through two main channels: commercial banks and remittance companies. Recognizing the importance of remittances for the socio-economic development of HCMC, the city has implemented various mechanisms and policies to encourage overseas Vietnamese and foreign workers to send money back home. For example, there is no income tax imposed on foreign currency remittances from overseas Vietnamese, and policies allow recipients to hold or deposit foreign currencies at credit institutions.

Meanwhile, MSB Bank reports that remittances to Vietnam through banks increased by approximately 20 percent in 2023 compared to the previous year. To attract more remittances, the bank has waived 100 percent of the remittance-receiving fees, offered attractive foreign exchange rates, and added a 0.3 percent interest rate on savings if the sender converts to Vietnamese dong and deposits at the bank. Additionally, Sacombank Remittance Company (SBR) stated that its remittance volume in 2023 increased by over 95 percent compared to 2022, marking the highest growth rate in the past five years.

Research conducted by the HCMC Committee for Overseas Vietnamese shows that, in recent times, remittances flowing into the city have gradually shifted towards investment in the stock market, bonds, business startups, production and business activities, services, and real estate. This positive trend directly contributes to expanding domestic investment, creating job opportunities, and generating revenue for the State budget from production and business activities.

Surveys within the overseas Vietnamese community, conducted by representatives of Vietnamese business associations in various countries, reveal that the second generation of overseas Vietnamese have a strong desire to return to Vietnam for investment. Especially, they need legal assistance in obtaining investment licenses, transferring funds, and engaging in commercial activities.

Associate Professor - Dr. Dinh Trong Thinh, economic expert from the Academy of Finance:

The increasing influx of remittances to Vietnam is a significant supplementary capital for investment in the domestic private economic sector, contributing to the overall development of the economy. This has contributed to ensuring the livelihoods of many families and supporting social welfare within the country. Remittance funds sent to relatives and families for expenditure, construction, and home purchases also stimulate domestic consumption.

Furthermore, remittances play a crucial role in nation-building and development, helping to increase the national foreign exchange reserves, reduce imbalances in the balance of payments, improve foreign exchange reserves, and alleviate pressure on the USD/VND exchange rate.

Mr. Nguyen Toan Vuong, General Director of Agribank:

In addition to offering favorable policies for remittance recipients, Agribank is progressively expanding its remittance services. With a network of over 1,000 agent banks worldwide, Agribank is dedicated to providing remittance services of high quality, convenience, and reliability to overseas Vietnamese and the Vietnamese diaspora, facilitating fast, safe, and convenient money transfers back to their homeland.

Remittances processed through official channels enable banks to reach households, provide financial services, and empower individuals to manage their personal finances while mitigating risks. Building upon this foundation, the bank intends to extend retail banking services to every person in rural areas, promoting savings and effective investment of remittances.