The stock market was weighed down by steep declines in Vingroup and Vietcombank shares, which curbed the VN-Index’s upward momentum on September 3.

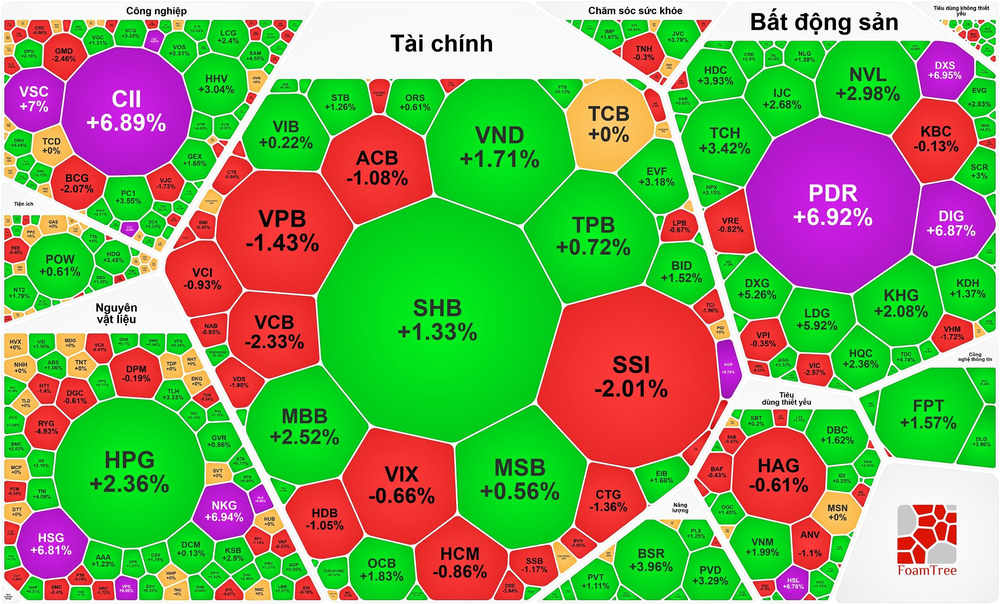

Commercial real estate and public investment stocks staged a strong rally: PDR, DIG, DXS, CII, and VSC all hit their ceiling prices; CEO surged 6.5 percent, DXG climbed 5.26 percent, TCH gained 3.42 percent, HDC advanced 3.83 percent, VCG rose 3.35 percent, PC1 added 3.58 percent, and HHV increased 3.04 percent.

Steel and oil & gas stocks also posted impressive gains: NKG and HSG both closed at their upper limits, HPG rose 2.4 percent, BRS gained 3.96 percent, PVD climbed 3.29 percent, and PVS advanced 3.54 percent.

Banking stocks showed a mixed picture, though more tilted toward the upside: EIB rose 1.68 percent, MBB jumped 2.52 percent, SHB gained 1.33 percent, STB added 1.26 percent, BID increased 1.52 percent, and OCB climbed 1.82 percent, while VIB and TPB each gained nearly 1 percent. In contrast, VCB fell 2.33 percent, VPB dropped 1.43 percent, HDB slipped 1.05 percent, ACB lost 1.08 percent, and CTG declined 1.36 percent.

Securities stocks, however, continued to be pressured by profit-taking, sinking into the red: SSI dropped 2.01 percent, SHS fell 2.05 percent, MBS declined 2.64 percent, and VDS slid 1.98 percent, while VCI, HCM, and CTS each lost nearly 1 percent.

At the close, the VN-Index edged down 0.91 points, or 0.05 percent, to 1,681.3 points, with 212 gainers, 110 decliners, and 54 unchanged stocks. Conversely, the HNX-Index gained 2.72 points, or 1.21 percent, to 282.7 points, with 118 stocks advancing, 55 retreating, and 48 standing still.

Liquidity fell, with total trading value on HOSE reaching over VND37 trillion, down VND8 trillion compared with the session before the holiday. Including HNX, liquidity stood at around VND40 trillion, a decrease of VND8.2 trillion.

Foreign investors extended their selling streak on HOSE for the fourth straight session, with net sales totaling nearly VND2.89 trillion. The three most heavily offloaded stocks were HPG (nearly VND955 billion), VPB (nearly VND204 billion), and FPT (nearly VND202 billion).