Processing seafood for export to Russia and the EU at an enterprise. (Photo: SGGP)

Processing seafood for export to Russia and the EU at an enterprise. (Photo: SGGP)

Experts predict that the Russia-Ukraine conflict will continue to push up fuel and food prices because countries tend to hoard goods. The high price of some agricultural, forestry and fishery products is an opportunity for Vietnamese enterprises to boost exports in the coming time.

According to the Ministry of Agriculture and Rural Development (MARD), in the first two months of the year, export turnover was estimated at US$8 billion, up 20.9 percent over the same period last year, and the country saw a trade surplus of about $1.8 billion, an increase of 86.7 percent year-on-year. Of which, exported pangasius had a high price.

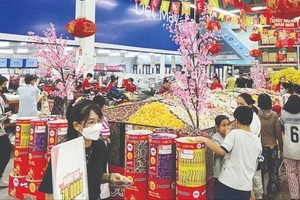

Rice export activity was vibrant at the beginning of the year with a two-month turnover of $441 million, up 22.3 percent over the same period last year. Enterprises assess that the rice export market will be more favorable this year because many markets are on recovery from the Covid-19 pandemic. In addition, the instability of the global economy has caused many countries to increase stockpiling food.

According to the Vietnam Food Association (VFA), this year, Vietnam will continue to exploit the advantages of the EU-Vietnam Free Trade Agreement to boost rice exports to the EU with a volume of no less than 60,000 tons. Recently, South Korea also announced the allocation of a tariff quota of 55,112 tons of rice to be imported from Vietnam with a preferential tax rate of 5 percent in 2022.

Regarding the two markets that are in conflict, according to the General Department of Vietnam Customs and the Ministry of Industry and Trade, in the past two months, import and export turnover between Vietnam and Russia, and Ukraine accounted for a small percentage.

For the Russian market, Vietnam's exports were worth $555.3 million, accounting for only 1.03 percent of the country's total export turnover; imports reached $446.2 million, accounting for only 0.8 percent.

As for the Ukrainian market, in the first two months of the year, Vietnam's exports reached $57.5 million, accounting for only 0.11 percent of the country's total export turnover, and the import value was only $8.4 million.

Many pressures and challenges

However, the Russia-Ukraine conflict and the impact of the continuously rising world gasoline prices have been causing several difficulties for Vietnam's agricultural production and the import and export of agricultural, forestry, and fishery products.

Currently, the prices of domestically produced fertilizers and imported fertilizers have increased by about 80 percent-130 percent compared to last year. Russia and China are the two leading fertilizer exporters in the world, so Russia's restriction on petroleum and fertilizer exports in retaliation for economic sanctions may have a worse impact on supply, while Vietnam is heavily dependent on imported fertilizers.

According to the Ministry of Agriculture and Rural Development (MARD), in the first two months of the year, export turnover was estimated at US$8 billion, up 20.9 percent over the same period last year, and the country saw a trade surplus of about $1.8 billion, an increase of 86.7 percent year-on-year. Of which, exported pangasius had a high price.

Rice export activity was vibrant at the beginning of the year with a two-month turnover of $441 million, up 22.3 percent over the same period last year. Enterprises assess that the rice export market will be more favorable this year because many markets are on recovery from the Covid-19 pandemic. In addition, the instability of the global economy has caused many countries to increase stockpiling food.

According to the Vietnam Food Association (VFA), this year, Vietnam will continue to exploit the advantages of the EU-Vietnam Free Trade Agreement to boost rice exports to the EU with a volume of no less than 60,000 tons. Recently, South Korea also announced the allocation of a tariff quota of 55,112 tons of rice to be imported from Vietnam with a preferential tax rate of 5 percent in 2022.

Regarding the two markets that are in conflict, according to the General Department of Vietnam Customs and the Ministry of Industry and Trade, in the past two months, import and export turnover between Vietnam and Russia, and Ukraine accounted for a small percentage.

For the Russian market, Vietnam's exports were worth $555.3 million, accounting for only 1.03 percent of the country's total export turnover; imports reached $446.2 million, accounting for only 0.8 percent.

As for the Ukrainian market, in the first two months of the year, Vietnam's exports reached $57.5 million, accounting for only 0.11 percent of the country's total export turnover, and the import value was only $8.4 million.

Many pressures and challenges

However, the Russia-Ukraine conflict and the impact of the continuously rising world gasoline prices have been causing several difficulties for Vietnam's agricultural production and the import and export of agricultural, forestry, and fishery products.

Currently, the prices of domestically produced fertilizers and imported fertilizers have increased by about 80 percent-130 percent compared to last year. Russia and China are the two leading fertilizer exporters in the world, so Russia's restriction on petroleum and fertilizer exports in retaliation for economic sanctions may have a worse impact on supply, while Vietnam is heavily dependent on imported fertilizers.

Processing seafood for export to Russia and the EU at an enterprise. (Photo: SGGP)

Processing seafood for export to Russia and the EU at an enterprise. (Photo: SGGP)

To reduce the negative impact of high fertilizer prices, Dr. Phung Ha, Vice Chairman cum General Secretary of the Vietnam Fertilizer Association, said that farmers should find ways to replace and use cheaper fertilizers more reasonably and increase the use of organic fertilizers. At the same time, it is necessary to ensure the supply, avoiding a shortage of domestically-produced fertilizers. Currently, domestic factories have been able to produce most of the key fertilizers, such as urea, DAP, superphosphate, fused phosphorus, ammonium nitrate, and NPK. There are only a few types, such as ammonium sulfate and potash fertilizer, completely dependent on imports. According to Truong Dinh Hoe, General Secretary of the Vietnam Association of Seafood Exporters and Producers (VASEP), although the turnover between Vietnam and Russia, and Ukraine is not large, in the past year, many Vietnamese enterprises paved the way to boost seafood exports to Russia. Currently, many businesses are worried that it will be difficult to collect money when Russia is excluded from the SWIFT system. To remove difficulties, the MARD suggests that businesses need to closely monitor the situation and work closely with the State Bank of Vietnam to support payments for businesses that exported goods to Russia, but financial transactions are stagnant. Enterprises also need to work with associations, such as the VASEP, Vietnam Coffee - Cocoa Association, Vietnam Cashew Association, and Vietnam Timber and Forest Products Association, to discuss solutions to handle difficulties in the immediate future due to the stagnation in the Russian and Ukrainian markets. To soon stabilize input material prices, the MARD will work with importing enterprises to discuss solutions to stabilize input prices for domestic agricultural production, attracting businesses to strengthen investment to be proactive in essential inputs for agricultural production, processing system, and agricultural logistics.

When instability occurs, agricultural trade between Vietnam and Russia, and Ukraine will decrease significantly due to the risks of banking transactions, lack of shipping vessels, and high costs. Businesses now have to monitor the situation to handle inventory or find ways to export to other markets.