Inhibition of business development

In early June 2023, Vietnam Timber and Forest Products Association blamed the delayed VAT refunds, which amounted to more than US$249 million (VND6,100 billion) for the lack of production capital and worker welfare in wood processing and exporting enterprises.

Similarly, Vietnam Rubber Association sent a document to the HCMC Tax Department claiming VAT refunds of more than $7 million (VND171 billion) for 10 rubber trading and exporting businesses. This can also be seen in large enterprises with foreign direct investment (FDI).

In the meeting with leaders of HCMC on August 16, leaders of Samsung Electronics HCMC CE Complex said that its VAT refund had been delayed for more than 2 years, the total amount of which reached $44 million.

|

| Taxpayers carry out procedures at the HCMC Tax Department. Photo: Khanh Chau/ SGGP |

According to the 2022 audit results reported by the State Audit, in some localities, the inspection and verification of VAT refund applications of export enterprises remains stagnant.

Statistics from the General Department of Taxation showed that in the first 7 months of 2023, the tax industry just refunded VAT of over $2.9 billion (VND71,800 billion), reaching 39 percent of the estimate, equal to 85 percent compared to the same period in 2022. By the end of August, the tax agency had just refunded more than $3.5 billion (VND87,100 billion), reaching 46.9 percent of the estimate for 2023 and equal to 90 percent compared to the same period in 2022.

In HCMC alone, from July 1, 2020 to June 30, 2023, there were 4,916 tax refund decisions issued, equal to more than $1.2 billion (VND30,600 billion). However, only 66.4 percent of them were resolved on time. As of June 30, the HCMC Tax Department was processing 612 tax refund applications, equivalent to $276.7 million (VND6,767 billion), including 520 applications for refunds after inspection and 92 applications for refunds before inspection.

Until mid-July this year, the question regarding the total amount of unrefunded VAT, which is very important to business operations, remained unanswered.

The Chairman of the National Assembly has clearly stated that it is the rights of the businesses to receive and the obligation of the State to pay VAT refunds. The National Assembly's Finance and Budget Committee is to hold an explanation session to monitor this issue and stop it from hindering production and business activities.

Acceleration with caution

In response to the disillusionment among businesses, recently, the National Assembly and the Government have implemented many policies, such as Official Telegram No. 470 dated May 26 directed by the Prime Minister to urgently inspect, evaluate and urge the General Department of Taxation to immediately facilitate the procedures for VAT refund promptly and effectively.

Accordingly, the General Department of Taxation has taken drastic action and up to now, nearly 80 percent of applications requesting VAT refund have been classified by the tax industry as being subject to tax refund first, inspection later.

|

People carry out tax payment procedures at the HCMC Tax Department. Photo: Hoang Hung/ SGGP |

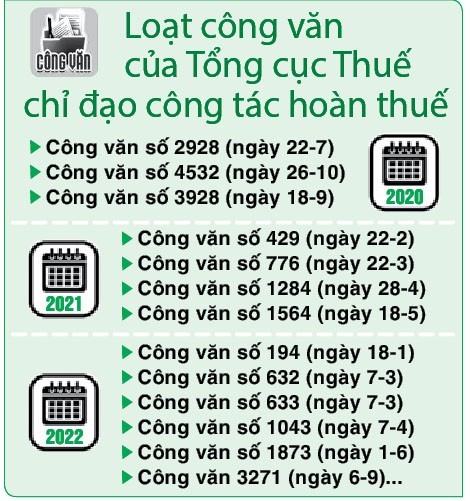

On August 9, the Director General of the General Department of Taxation continued to issue Official Telegram No. 07 requesting local tax departments to speed up the processing of VAT refund applications. Explaining before meetings of the Government and the National Assembly, leaders of the General Department of Taxation always affirmed that constant efforts had been made, in terms of tight supervision and weekly reports on the localities.

In fact, the current difficulties stem from the General Department of Taxation's directive documents requiring local tax departments to limit tax refund risks by implementing a range of measures, some of which are highly demanding.

To be more specific, Official Dispatch 1873 dated June 1, 2022 requires verification of invoices and the origin of goods to the final stage in the case of complicated invoices. It also involves checking the actual warehouse and delivery information of each shipment.

Similarly, in Official Dispatch 194 dated January 18, 2022, businesses asking for VAT refund on the export of rubber, cassava chips, and agricultural products must carry out the whole process of verification to the final stage of afforestation, with accurate inspection results from intermediary businesses. At the same time, the report verifies whether transportation, loading, gasoline, and road fees are consistent with the transportation route, documents, and goods volumes of each batch.

According to the tax industry, the above instructions were issued out of caution, given the many tax violations detected in recent times. For example, in 2022 and early 2023, the dossiers of 9 businesses requesting VAT refunds on wood and products made from wood, wood chips, and wood pellets have been transferred to public security agencies to coordinate investigation and verification as these enterprises showed signs of using false invoices for tax refund. Besides, there were said to be 524 businesses with high invoice risks.

|

The Ministry of Finance is proposing to amend the VAT Law, including an important part relating to tax refund. In addition, the business community in particular and the public in general are also paying close attention to the upcoming explanation session of the National Assembly's Finance and Budget Committee on tax refunds, by which businesses hope can resolve the existing problems related to tax refunds.