Unprecedented ascendancy of gold prices

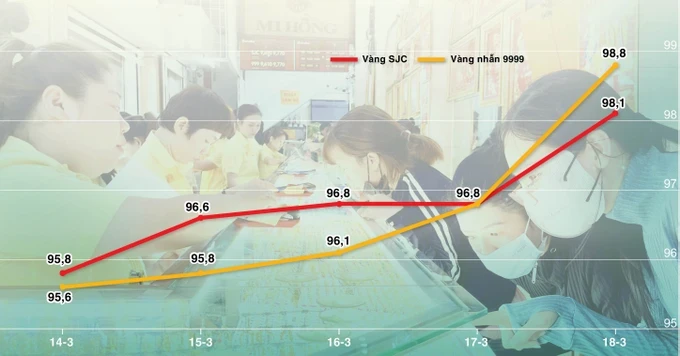

Driven by the prevailing global gold price trends, domestic gold prices have consistently surpassed prior benchmarks, establishing new record highs. On March 18, both SJC gold bars and 9999 gold rings registered exceptional peaks, exceeding VND98 million (US$3,838) per tael.

Yesterday afternoon, Bao Tin Minh Chau Co. quoted 9999 gold ring prices at VND97.25 million ($3,800) per tael for purchase and VND98.8 million ($3,869) per tael for sale, reflecting daily increments of VND2.05 million ($80) for both purchase and sale.

SJC and PNJ Companies’ SJC gold bar prices escalated to VND96.6 million ($3,783) per tael for purchase and VND98.1 million ($3,842) per tael for sale, an all-time high.

Consequently, since the commencement of the year, SJC gold bar prices have surged by VND13.9 million ($544) per tael, and 9999 gold ring prices have increased by VND14.8 million ($580) per tael, representing proportional gains of approximately 15-16 percent.

Global gold prices have also reached record levels. Spot gold prices on the Kitco exchange, as of yesterday afternoon (Vietnam time), exceeded $3,000 per ounce, trading at $3,021 per ounce, a rise of approximately 14 percent. Upon conversion, this price equates to VND93.1 million ($3,646) per tael, approximately VND5 million ($196) per tael lower than SJC gold bars and VND5.7 million ($223) per tael lower than 9999 gold rings.

The State Bank of Vietnam (SBV) attributes the substantial increase in domestic gold prices primarily to the upward trend of global gold prices. Dr Nguyen Tri Hieu noted that global gold prices have established record highs on 13 occasions since the beginning of the year and are currently stabilizing above the historical threshold of $3,000 per ounce.

This occurs against a backdrop of decelerating US economic indicators and heightened geopolitical instability stemming from tariff policies, thereby enhancing gold’s appeal as a “safe haven” asset. Within the domestic gold market, 9999 gold ring prices have surpassed SJC gold bar prices due to the latter’s ongoing stringent regulatory oversight by the SBV.

The allure of the Vietnamese stock market

Since the beginning of this year, the Vietnamese stock market has registered a 5-percent increase. The VN-Index reached 1,330.97 points on March 18, accompanied by progressively improving liquidity. Recent average daily trading values have exceeded VND20 trillion ($783.3 million), representing a 20-to-30-percent rise compared to the corresponding period of the preceding year. This underscores the sustained strength of domestic capital flows, despite persistent net selling by foreign investors on the HOSE exchange.

Senior Director Tyler Nguyen Manh Dung of Market Strategy Research at HSC Securities Corp. attributed the Vietnamese stock market’s eight consecutive weeks of growth to consistently positive macroeconomic data, reinforcing confidence in the economy’s recovery momentum.

Based on the Vietnamese stock market’s positive performance, numerous securities firms project that the VN-Index will surpass 1,500 points this year. A favorable domestic macroeconomic environment is deemed a critical supporting factor.

According to Director Tran Duc Anh of Macroeconomics and Market Strategy at KBSV Securities Co., Vietnam’s 8-percent GDP growth target for the year represents a decade-high ambition. The anticipated implementation of accommodative monetary and fiscal policies to achieve this target is also expected to provide market support.

Furthermore, the Government’s expansion of the public investment plan to $36 billion and the revision of various policies to enhance the business environment are intended to stimulate economic growth. Additionally, the realization of the goal of early upgrading to a secondary emerging market status for the Vietnamese stock market is expected to bolster liquidity and attract capital inflows.

)

)