Various businesses adjusted their gold prices upwards, with some increasing the price of SJC gold bars and 9999 gold rings by nearly VND1 million per tael.

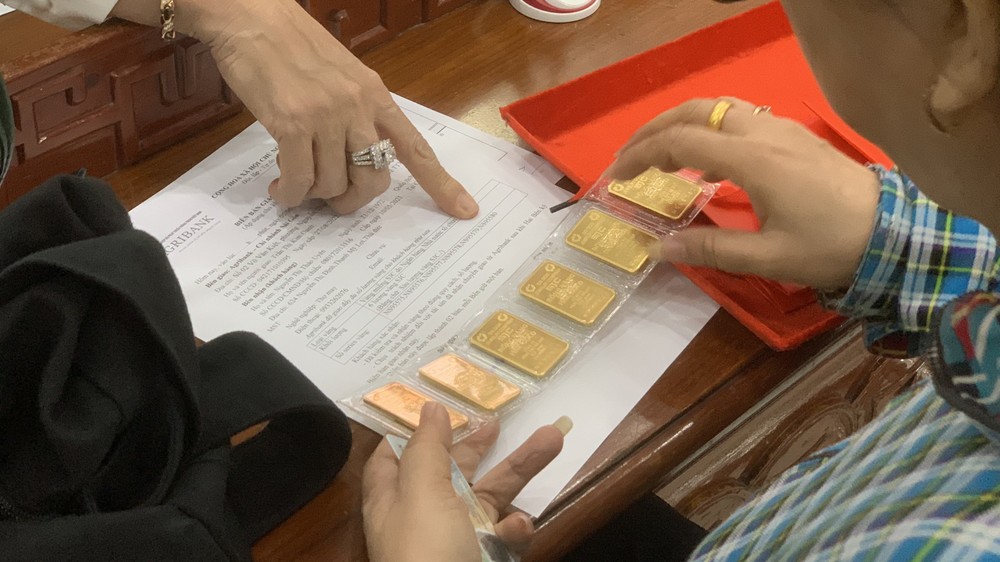

Specifically, around 1 p.m., SJC gold bars were raised by VND800,000 in both buying and selling prices by Saigon Jewelry Company and Bao Tin Minh Chau, with the price listed at VND86.9 million per tael for buying and VND88.9 million per tael for selling.

PNJ increased both buying and selling prices by VND500,000, with the price listed at VND86.9 million per tael for buying and VND88.9 million per tael for selling.

Phu Quy Group raised the buying price by VND200,000 and the selling price by VND500,000, with the transaction price for SJC gold bars set at VND86.4 million per tael for buying and VND88.9 million per tael for selling.

The price of 9999 gold rings also continued to rise. Bao Tin Minh Chau made the largest adjustment in the market, matching the price of SJC gold bars. The price of plain gold rings was listed at VND86.6 million per tael for buying, up VND200,000 and VND88.9 million per tael for selling, up VND850,000.

PNJ raised its buying price by VND400,000 and selling price by VND200,000, with the transaction price at VND86.5 million per tael for buying and VND87.9 million for selling.

Phu Quy Group increased both buying and selling prices by VND100,000, with the listed price at VND86.1 million per tael for buying and VND 88.1 million for selling.

SJC raised both buying and selling prices by VND100,000, with the listed price at VND86.2 million per tael for buying and VND87.9 million for selling.

On the global gold market, gold prices closed at US$2,752.8 an ounce in New York on the night of January 23, down by $3.1 from the previous session. The spot gold price on Kitco rose to $2,777.1 an ounce on January 24 (Vietnam time). After conversion, this price is equivalent to VND84.3 million per tael, which is about VND4.6 million lower than SJC gold and VND4.1-4.6 million lower than 9999 gold rings.

Gold prices have been fluctuating near their peak as investors buy gold to hedge against risks from the new policies of US President Donald Trump. Additionally, rising bond yields and a cooling US dollar have continued to support gold prices. The yield on 10-year US Treasury bonds increased by 0.47 percentage points to nearly 4.65 percent, while the DXY index dropped to 108.5 points from 108.17 points.

Analysts believe that President Trump's key policies—such as tariffs on imported goods, domestic tax cuts, and the deportation of illegal immigrants—could affect gold prices in two different ways. On one hand, rising inflation risks from these policies may enhance gold's role as an inflation hedge and a safe investment. On the other hand, higher interest rates for a prolonged period due to inflation could exert downward pressure on gold prices.