|

Customers do transactions at a bank in HCMC. |

Given the challenging conditions of the corporate bond market, businesses are struggling to secure new capital while also dealing with a substantial load of maturing bonds. However, the imminent launch of a corporate bond trading platform is expected to inject much-needed momentum into the market in the coming time.

Over VND130 trillion of corporate bonds mature at year’s end

After a period of stagnation, the market has witnessed successful corporate bond issuances in 2023. According to the Vietnam Bond Market Association (VBMA) statistics as of early June 2023, the total value of corporate bond issuances amounted to around VND35.51 trillion from seven public issuances and a total value of VND29.99 trillion from 19 privately-placed issuances.

Overall, the corporate bond market has shown positive signals thanks to continuous policy issuances over the past time. In particular, Government Decree No.08, issued in March 2023, amended and supplemented various provisions of decrees related to private placement corporate bonds to address temporary challenges and restore confidence in the corporate bond market. As a result, not only have enterprises successfully issued new batches of corporate bonds but they also have a legal basis for restructuring, extending the maturity of corporate bonds, or settling corporate bonds with other assets within two years.

According to statistics from the Vietnam Stock Exchange (VNX), many enterprises have successfully engaged in negotiations with investors to extend the maturity or convert their corporate bonds into assets, including Bulova Real Estate Group and Hung Thinh Land Corporation. In the most recent development, in June 2023, Novaland Investment Group successfully negotiated with bondholders to extend the maturity of two bond batches with a combined issuance value of VND2.3 trillion, with repayment terms extended until 2025. Furthermore, enterprises have actively repurchased corporate bonds before maturity, resulting in a total value of VND99.04 trillion accumulated since the beginning of the year, an increase of nearly 51 percent compared to the same period in 2022.

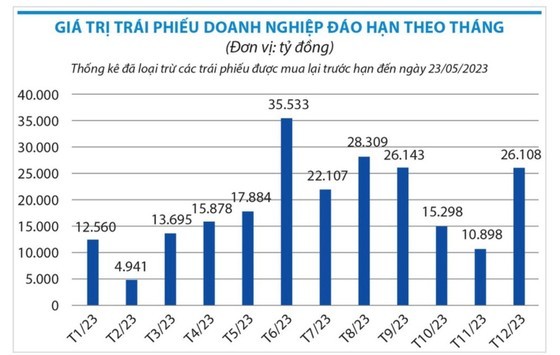

However, according to calculations by securities companies, the remaining six months will see over VND130 trillion worth of corporate bonds maturing, with a significant portion originating from the real estate sector amounting to VND87.85 trillion, accounting for 52 percent, followed by the banking sector with VND30.26 trillion, accounting for 17.8 percent. Statistics from Finn Group reveal that more than 100 issuers have delayed fulfilling their corporate bond repayment obligations with a total value of hundreds of trillion Vietnamese dong. The HSC Securities Company's calculations suggest that, in the base scenario, the number of corporate bonds with late payments could reach VND77.4 trillion by the end of this year.

Bringing privately-placed corporate bonds to the exchange

In addition to the positive trend of bond extensions, recently, another eagerly anticipated boost is the introduction of a corporate bond trading platform. According to the Ministry of Finance, the corporate bond trading floor is expected to be launched and operational in July. By including the corporate bond market, valued at over VND1.1 quadrillion, accounting for 11.6 percent of GDP in 2022, in official trading, it is anticipated that liquidity in the secondary market for privately-placed corporate bonds will be enhanced. This move will facilitate smoother transactions, increase market transparency and standardization, and ultimately restore investor confidence in the corporate bond market.

|

| Monthly maturity value of corporate bonds |

The Vietnam Securities Depository (VSD) is currently collaborating with the Hanoi Stock Exchange (HNX) to establish the trading system for privately-placed corporate bonds of HNX, as well as the registration, depository, and settlement system for private placement corporate bond transactions at VSD. These systems will be interconnected and synchronized to facilitate investor registration and improve management, ensuring compliance with legal regulations for privately-placed corporate bond transactions.

Privately-placed corporate bonds are traded through negotiated transactions, often involving significant transaction volumes. Therefore, VSD will implement immediate settlement for each transaction, adopting a T+0 settlement cycle. The draft regulations regarding the registration, depository, and settlement of individual corporate bond transactions will be issued in the near future. Additionally, VSD has completed the necessary preparations, ensuring the readiness of the registration, depository, and settlement system for privately-placed corporate bond transactions to begin operations.

According to financial experts, the establishment of a trading platform for privately-placed corporate bonds will provide bondholders with additional opportunities to sell their bonds if they find buyers. This will also help companies alleviate the pressure of debt repayment from bondholders. "Many investors are holding privately-placed corporate bonds with expectations of supervision and regulatory capabilities from the State Securities Commission. Once a secondary transaction is established, both parties involved in the transaction will be required to adhere to their agreements and be subject to regulatory oversight. If either party fails to fulfill their commitments, regulatory measures will be implemented to prevent the spread of risks and maintain investor confidence," stated the leader of Bao Viet Securities Company.

Mr. NGUYEN QUANG THUAN, CEO of FinnGroup, emphasized that investors should be aware that, in reality, through banks and securities companies, the buyer and the seller have already agreed upon the transaction. Listing on the exchange serves to formalize the transaction and provide legitimacy for both parties. Unlike stocks, corporate bonds lack liquidity, so listing them aims to enhance transparency, verify the transparency of bondholders, and mitigate potential disputes.