|

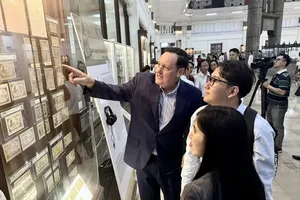

On April 28, the 2023 Annual General Meeting of Shareholders (AGM) was held by Orient Commercial Joint Stock Bank (OCB) in Ho Chi Minh City. |

OCB has announced that it fully recovered the debts of its two major customers, FLC Group and Dai Nam Company, by collecting the entire outstanding amount and receiving collateral assets in lieu of the obligation to repay these debts. Both of these debts have already had a buyer and are allowed to make payments and sell to a third party.

On April 28, the 2023 Annual General Meeting of Shareholders (AGM) was held by Orient Commercial Joint Stock Bank (OCB) in Ho Chi Minh City. During the meeting, OCB reported on its business performance in 2022, outlined the business plan for 2023, and addressed other important matters.

In light of the current economic challenges, OCB's Board of Directors has deemed it necessary to increase the bank's charter capital to bolster its financial capacity and meet regulatory requirements regarding Capital Adequacy Ratio (CAR). OCB currently holds VND7.04 trillion in retained earnings, consisting of VND2.94 trillion from 2022 and VND4.09 trillion from previous years.

To facilitate business operations, the bank has proposed utilizing retained earnings and other sources of shareholder equity to increase its charter capital. The plan is to issue approximately 685 million shares to existing shareholders, which would represent a 50 percent ratio. If successful, the bank's charter capital will rise from nearly VND13.7 trillion to VND20.55 trillion.

Mr. Nguyen Dinh Tung, CEO of OCB, has responded to shareholder queries regarding non-performing loans (NPLs) from two of the bank's major clients, FLC Group and Dai Nam Company. He confirmed that OCB has fully recovered outstanding debts from both clients and has already sold off their asset portfolios.

At present, OCB is giving a third party some time to arrange payment. Concerning OCB's acquisition of the building at No.265 Cau Giay Street in Hanoi from FLC for investment purposes, the bank was unable to transfer the property title in 2022 due to FLC's financial difficulties. Consequently, OCB decided to terminate the contract, and FLC has since reimbursed the bank, including penalty fees, Mr. Tung added.

Mr. Trinh Van Tuan, Chairman of OCB's Board of Directors, responded to shareholder inquiries about dividend distribution by stating that OCB had taken steps to distribute profits to shareholders immediately after the 2022 Annual General Meeting of Shareholders. OCB had completed the capital increase process in accordance with the procedural sequence, and it was approved by the State Bank of Vietnam.

However, the next step involves working with the State Securities Commission, which requires more detailed and complex documentation. Thus, the bank needs to provide additional information. To safeguard shareholder rights, OCB will consolidate profits from this year and the previous year into a single distribution instead of prolonging the payout period, he said.

)

)