According to Decision No.2345/2023 by the State Bank of Vietnam (SBV) on implementing security solutions for online payments and bank card payments, starting from July 1, 2024, online money transfers or e-wallet deposits exceeding VND10 million (US$393) per transaction or VND20 million ($786) per day, and bill payments exceeding VND100 million ($3,930) must be authenticated by facial recognition against the centralized population database.

Banks and e-wallet service providers have been notifying customers to update their biometric authentication before July 1 to avoid disruptions when performing large transactions.

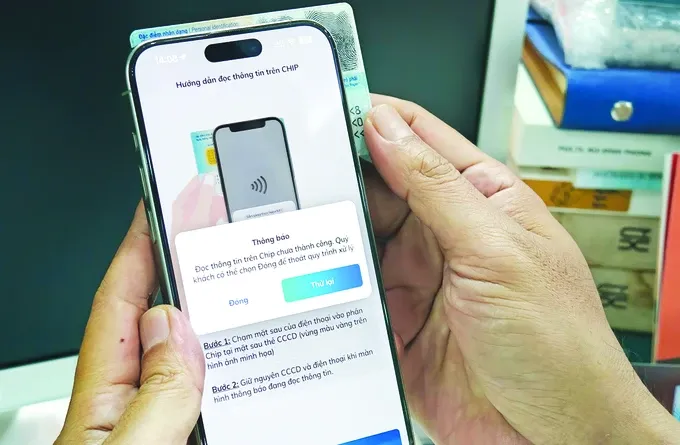

The process can be done directly on the bank's or e-wallet's application. Users only need to perform facial recognition, take a photo of their chip-based ID card and scan the card’s information using NFC on their mobile device. However, many users have reported encountering difficulties with authentication, with the system constantly showing errors or due to incompatible devices.

Right when receiving his bank’s message about this matter, Nguyen Tat Thang (living in Tan Binh District of HCMC) followed all instructions on the bank’s app step by step. Nevertheless, the process repeatedly failed due to the inability to scan the information on the chip-based ID card.

Similarly, Nguyen Anh Tuan from Go Vap District of HCMC shared that as his ATM card had been damaged at the beginning of June 2024, he received instruction from his bank to update necessary biometric information on the bank’s app to complete the new card application procedure. Yet the system did not recognize him even after several times scanning his face and chip-based ID card.

People who open accounts in multiple banks face even more challenges as each bank’s app requires a different procedure, which greatly annoys them.

Bank customers reported that the most troublesome step in this biometric authentication procedure is to scan their chip-based ID card, asking for much patience from them. Although this process is critical in tightening asset protection in banks, it is truly frustrating, especially to the elderly who are not tech-savvy.

According to the 2023 Identity Law, biometric data is a unique identifier of an individual, with no two people being the same, including twins. Each citizen's biometric data has been collected and stored by the Ministry of Public Security in the chip-based ID card. Therefore, implementing biometric authentication will enhance security, prevent unauthorized access, and minimize the possibility of fraud when using online banking applications.

However, a significant number of smartphone users do not have devices that support the NFC function, and some people's facial features are not entirely identical to the photos on their chip-based ID card, making it challenging to perform facial recognition authentication. Additionally, the elderly and those who are not tech-confident face difficulties in updating their information according to the bank's requirements, especially since each bank has a different update method.

General Director Nguyen Hung of TPBank informed that TPBank offers a multi-channel approach to facial recognition authentication, providing customers with flexibility and convenience. Accordingly, this process can be done via the bank’s app with a chip-based ID card, a smartphone supporting NFC, and the latest version of the app. Alternatively, customers can directly visit any office of the bank, and the staff is ready to guide them through the facial recognition update process.

ACB has integrated facial recognition authentication into the latest version of its ACB ONE Digital Banking app. Customers also need to have at hand their valid chip-based ID card and a smartphone supporting NFC to ensure the registered facial data matches the biometric data verified and stored by the Ministry of Public Security.

BVBank's Digimi Digital Banking app provides a straightforward 4-step facial recognition registration process. The requirements to carry out this process at home are similar to the two above banks.