|

Lending interest rate unlikely to fall more in last months despite SBV’s attempts to trim it |

After the State Bank of Vietnam asked to lower interest rates four times since the beginning of 2023, commercial have seen fewer depositors resulting in lower current lending interest rates.

According to the State Bank, Vietnam dong lending interest rates have decreased on average by about 1.5 percent - 2 percent a year compared to the end of 2022 and are expected to continue to decrease in the near future due to policy delays after adjustments of operating interest rates.

Standing Deputy Governor of the State Bank Dao Minh Tu said that the State Bank continues to lower interest rates; therefore, he instructed commercial banks to save costs and reduce lending interest rates for businesses. However, HSBC Bank experts say that several risk factors will influence interest rates. For instance, average inflation in 2023 is forecast to increase to 3.4 percent instead of 3.2 percent as previous prediction.

Therefore, according to experts, no expectation that the State Bank will cut interest rates this year because of increasing inflation and foreign currency pressure.

According to a leader of a commercial bank in Ho Chi Minh City, lending interest rates have recently decreased, but deposits have reached maturity dates, and savers can withdraw their money so it will be difficult to cut lending interest rates further. Since the beginning of October 2023, the State Bank has reduced the ratio of short-term capital for medium and long-term loans from 34 percent to 30 percent, but pressure from inflation and exchange rates will hinder further reduction.

The bank is implementing a positive real interest rate policy. It means that the rate of return a person receives on their savings accounts is higher than the inflation rate; however, the savings interest rate is currently low; thus, if it decreases further it will threshold level of inflation, so if the borrowing cost drop, it will be slight, said a bank leader.

Member of the National Financial and Monetary Policy Advisory Council Can Van Luc also said that the State Bank may not need to further reduce regulatory interest rates, because deposit interest rates are currently at a reasonable level and will trigger a reduction in lending interest rates; thereby, helping improve credit growth.

According to Standing Deputy Governor of the State Bank Dao Minh Tu, a deep fall in interest rates is likely to break exchange rate stability affecting foreign debt and national credit ratings.

Although interest rates dropped sharply, credit growth as of October 11 only reached 6.29 percent, much lower than the same period in 2022 with 11.12 percent and the orientation in management for the year 2023 from 14 percent to 15 percent. Therefore, in his telegram, Prime Minister Pham Minh Chinh asked for drastic implementation of solutions to increase access to credit capital and remove difficulties for production and business activities.

In addition, he required further establishment of connections between banks and businesses as well as continued support for customers bumping difficulties, and promotion of production and business recovery. He urged the banking industry to push capital into the economy with many different credit stimulation solutions to meet businesses’ thirst for capital to boost production and business during the year-end peak season.

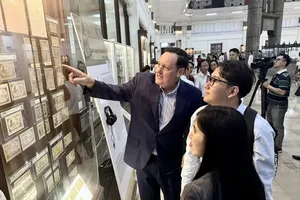

In addition, the banking industry is currently focusing on connecting supply and demand to remove difficulties for businesses and enhance its communication on policy. Since the beginning of the year until now, the State Bank has organized hundreds of meetings with businesses across the country to listen to their expectations.

Standing Deputy Governor of the State Bank Dao Minh Tu affirmed that the bank will take drastic measures with the assistance of local administrations to remove difficulties for businesses in the difficult economic context. However, according to analysts’ assessment, credit growth will hardly reach 14 percent but experts also forecast that credit growth will still reach 10 percent to 12 percent based on general expectations that individual customers’ consumption will recover at the end of the year.

)

)