Value-added tax (VAT) refunds in the past year have become a hot issue on many forums, because many businesses have been facing delays in receiving refunds on the value-added tax, affecting their production and business activities.

However, VAT refund fraud still occurred causing budget loss and inequality in business.

In early June 2023, the People's Court of Ho Chi Minh City heard a case related to Thu Duc Housing Development Company.

Among them, 18/67 defendants are tax officials who are being prosecuted for their involvement in helping a criminal group appropriate more than VND500 billion (US$20,295,728) in VAT refunds. This criminal group set up a series of domestic and foreign ghost companies, producing fake and poor quality goods, then carrying out untrue import and export procedures to increase the value of the goods, and then requesting a refund of VAT.

Similarly, the People's Court in the Northern Province of Phu Tho has recently brought to trial the case of the sale and purchase of more than 1 million VAT invoices, with an amount of over VND64,000 billion -the largest case ever.

After the detection of the sale and purchase of more than 1 million VAT invoices, the tax industry has announced a list of 524 high-risk businesses regarding invoices and thousands of businesses must explain their use of invoices.

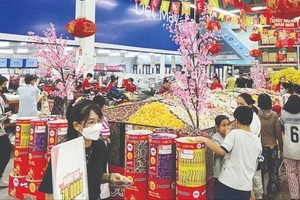

According to Deputy Director of Ho Chi Minh City Tax Department Nguyen Tien Dung, recently many cases of VAT fraud have been discovered in the production of rubber, wood chips, and cassava starch. When verifying, it was discovered that foreign partners indeed did not exist, or foreign partners denied having transactions with domestic enterprises.

Elsewhere in the country, the Tax Department in the Southern Province of Dong Nai has transferred the files of three businesses to the investigation agency because of signs of fraud in VAT refunds. Director of Dong Nai Provincial Tax Department Nguyen Toan Thang disclosed that the total amount of tax refund fraud is up to VND679 billion.

According to the General Department of Taxation’s statistics, inspectors discovered many tax frauds in 2023 and collected more than VND1,035 billion from the amount of tax refunds for the state budget. Cases relating to the detection of VAT fraud or signs of fraud along with criminal trials for tax officials who gave a hand to help businesses commit tax fraud are considered to be one of the reasons for delays in tax refunds at times.

Faced with delays in VAT refund work, the General Department of Taxation accepts responsibility for the slow implementation of risk management when classifying tax refund dossiers according to regulations. Until the end of October 2023, the General Department of Taxation applied the automatic classifying of VAT refund dossiers in the sector according to risk assessment and scoring criteria.

While working with local tax departments that have a large backlog of documents such as Hanoi, Ho Chi Minh City, Ba Ria-Vung Tau, Binh Duong, Dong Nai, the Department of Tax Declaration and Accounting under the General Department of Taxation realized that the application of the automatic classifying VAT refund dossiers has resulted in a sudden increase in the rate of pre-checked and post-refunded records compared to the average of previous years.

Regarding anti-fraud solutions and effective implementation of VAT refund work in the coming time, Director General of the General Department of Taxation Mai Xuan Thanh said that inspectors must be proactive, not waiting for businesses to submit tax refund documents but must supervise firms in advance. Currently, more than 8,000 businesses countrywide regularly refund export taxes, so the tax sector should create long-term records on these businesses.

In 2024, the General Department of Taxation will focus on tax management and electronic invoices, recommending the completion of regulations to prevent the establishment of ghost businesses from illegally issuing and using electronic invoices to cheat on tax refunds and profit from the state budget. At the same time, the tax department proposed tax management mechanisms and policies in the direction of more clearly defining the responsibilities of tax authorities and tax officials with taxpayers when authorities detect fraudulent acts in tax refunds.

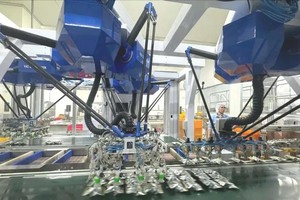

In addition, the General Department of Taxation will increase the application of information technology in tax refund processing, gradually automating and digitizing the process of receiving, processing and disbursing VAT refunds to ensure transparent and timely tax refund work in accordance with the law and prevent and prevent fraud as much as possible. It is hoped that the application of IT will help tax officials review business chains that buy and sell goods with tax refund businesses before receiving tax refund applications to help early identify high-risk tax refund cases and speed up tax refund time.

According to the General Department of Taxation, the implementation of risk management applications in automatic classifying VAT refund dossiers has helped speed up the processing of tax refund applications and prevent fraud. By the end of 2023, the number of VAT refund applications pushed into the application to classify tax refund applications as checking first, refund later, or refund first, checking later is 2,422 documents.