On the morning of October 18, Sai Gon Giai Phong Newspaper's Investment and Finance, in collaboration with the Center for Business Research and Enterprise Support (BSA), held a seminar titled "Green Finance: Balancing Benefits and Risks Between Businesses and Banks."

Expert: Technology as a tool to mitigate financial risks

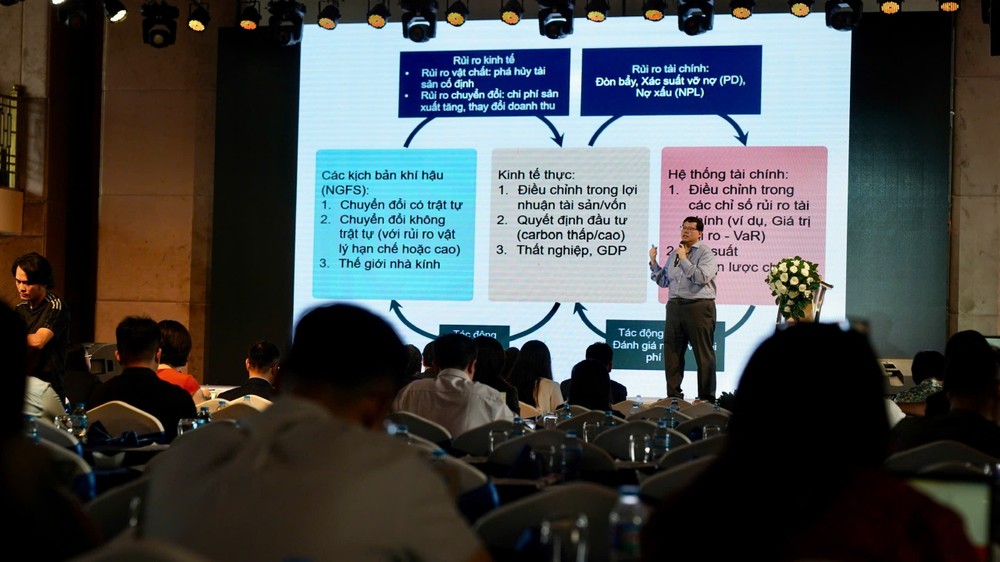

Speaking on behalf of the research group, Mr. Ho Quoc Tuan addressed the importance of sharing both benefits and risks between businesses and banks. He highlighted that climate change is an imminent risk, directly impacting the financial system.

In Europe, banks previously only needed to report on credit, liquidity, and operational risks. However, in the past two years, they have also been required to disclose financial risks related to climate change.

Tuan noted that Eurozone banks have diversified their capital sources to help businesses transition toward sustainable production.

Discussing the green transition, Ms. Nguyen Thi Thu Ha from the Ho Chi Minh City University of Economics highlighted new funding approaches to support businesses in their shift toward sustainability, noting that traditional financial products and services have not effectively facilitated this transformation.

According to Ms. Nguyen Thi Thu Ha, funding should come not only from banks but also from venture capital funds, institutional sponsors, angel investors, and development finance institutions (DFIs). The trend of blended finance, which combines public and private capital, plays a crucial role in mitigating risks and attracting investments in climate-related projects.

She emphasized that financial technology is essential for reducing climate-related risks for businesses. It not only minimizes physical risks but also improves companies' ability to forecast and manage resources effectively. In fact, some textile and export companies in Vietnam are already utilizing technology to enhance their resource management.

She also recommended a stronger focus on open innovation, particularly in investing in climate tech startups. Currently, these startups, especially in deep tech, have received less than US$2 million in early-stage funding in Vietnam, while they require at least $5 million to secure adequate resources for their development. Additionally, development finance institutions should serve as anchor sponsors to help mitigate investment risks. It is vital to unlock international funding flows for startups, including from angel investors, early-stage venture capital, deep tech venture capital, and professional impact investors.

In this transition process, how are banks getting involved? According to her, as the market evolves, banks must adapt. Currently, environmental, social, and governance (ESG) investment strategies are gaining significant attention, and banks that develop and optimize their ESG practices will phase out loans to businesses that do not meet these standards. Additionally, integrating ESG considerations into credit analysis and decision-making can help banks assess the risks associated with clients and loan projects, create new credit products, and incorporate ESG into their lending portfolios.

Many banks have started to refuse loans to high-emission industries, such as coal, actively seeking to finance businesses with strong ESG performance and prioritizing loans to companies focused on climate change. Furthermore, as shareholders in various organizations, banks can promote ESG initiatives across multiple sectors.

Ms. Bui Thi Thu Ha, Project Manager of Fair Finance Vietnam (FFV), noted positive changes in ESG policy commitments among most commercial banks in Vietnam from 2020 to 2022. In the 2022-2024 period, FFV's analysis indicates a positive trend, with banks increasingly disclosing information and establishing clearer environmental and social risk management frameworks. Some banks have begun implementing ESG requirements for businesses seeking financing or credit, and there are policies in place to receive and address feedback on ESG issues from individuals and communities affected by the banks' investments and loans. This, in turn, influences and raises awareness among businesses.

Ms. Bui Thi Thu Ha recommended that commercial banks establish policies to require or encourage clients to declare and fulfill their ESG commitments.

The story from businesses: One order, 86 green criteria

During the discussion, Ms. Vu Kim Hanh analyzed that, based on expert research, while the changes are just beginning, there is a significant yet quiet effort from banks despite the challenges they face.

Ms. Hanh pointed out that there are frequent complaints about banks having excess capital while businesses struggle to access it. If viable technological solutions could bridge this gap, it would instill more confidence and enable better monitoring of credit access.

Building on Ms. Hanh's insights, Mr. Vu Manh Hung, Chairman of Hung Nhon Group, shared that the company has implemented GlobalGAP standards across all its farms since 2006. The substantial investment in wastewater treatment and biogas systems serves as the "lungs" of the business. The group is currently focusing on its strengths in animal husbandry and aims to form joint ventures with European corporations to enhance its supply chain and address green economic challenges.

As an industry deeply committed to investing in green criteria, Mr. Vu Duc Giang, Chairman of the Vietnam Textile and Apparel Association (VITAS), reported that in the first nine months of the year, the industry achieved exports totaling $32.2 billion, with a target of reaching $44 billion by year-end.

Mr. Vu Duc Giang emphasized that the textile industry has been proactive in obtaining green certifications, particularly over the last five years; without them, it would not secure orders like it does today. Certifications from European, American, Japanese, and Korean markets are particularly demanding, and even China has begun imposing strict requirements on textile products. In 2023, the industry is exporting to 104 global markets, diversifying its customer base and product offerings.

In Ho Chi Minh City, the Vietnamese textile industry has established automated factories. For example, Phong Phu International Company operates a robotized facility in District 9 that meets green standards.

He emphasized the significant benefits of the textile industry. However, companies must meet 86 evaluation criteria to secure a single order, which is no easy task.

So, what direction should they take? Major brands like Nike, Adidas, and H&M now require businesses to eliminate the use of coal or wood for their boilers and instead rely on electricity, resulting in a 15 percent increase in production costs for burning fabric scraps. Over the past five years, Vietnamese companies have not been able to raise prices on their orders, yet they continue to operate efficiently, providing jobs for approximately 2.8 million workers across around 7,000 businesses.

To meet green standards, companies must make fundamental investments; adopting digital management and automation is essential.

Who are green customers?

In response to the question of who and where green customers are, Mr. Tran Hoai Phuong, Director of the Corporate Banking Division at HDBank, explained that green customers are businesses that recognize the need to adopt sustainable practices, those that the bank encourages to "go green," and companies motivated by foreign investors.

According to Tran Hoai Phuong, the businesses actively seeking to adopt green practices are primarily exporters, as their products must meet specific green criteria. They include exporters in the footwear and garment sectors, whose factories utilize solar energy. These businesses are leading the way in the green movement and represent the first category of green customers. Following them are exporters in the agricultural sector.

HDBank has engaged early with international development financial institutions and successfully raised $500 million in green lending capital. This experience has enabled the bank to learn from global trends and effectively persuade businesses to join their green initiatives.

The leadership at HDBank shared that starting from 2024, all corporate clients will be assessed not only on financial and credit risks but also on environmental and social risks. The bank has had to "grit its teeth" and turn away some clients who do not meet these standards, such as those in the tobacco, hydropower, and thermal power industries.

For instance, when a company in the North sought financing to import cement, HDBank conducted further investigation and discovered that the cement was intended for a thermal power plant, leading them to decline the application. While this decision may result in losing clients and receiving complaints, it aligns with their strategic goals. Phuong emphasized that businesses working with HDBank will receive comprehensive guidance on green transformation at no charge.

He also mentioned that by the end of this year, HDBank will issue $100 million in green bonds for the first time, with assistance from the IFC, targeting potential clients in the solar energy, agriculture, and waste-to-energy sectors. Selling a green product does not automatically make a company sustainable; it also requires considerations of environmental and social factors, including working conditions and child labor.