|

Illustrative photo. (Photo: SGGP) |

Banks earn huge profits

In Vietnam, the economy relies heavily on bank credit, so banks are both "lenders" and "creditors". Therefore, even when the economy faces many difficulties, and many businesses go bankrupt due to the impact of Covid-19, the banking industry still thrives.

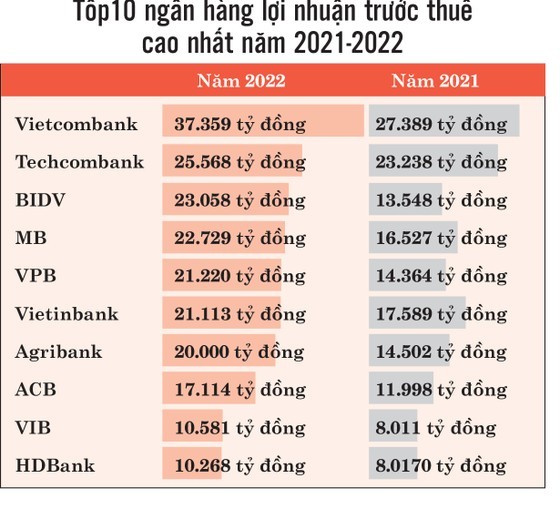

According to the financial reports of 26 commercial banks listed on the stock exchange and Agribank, a State-owned bank but not listed, the banking industry's profits in 2022 are estimated to reach about VND265 trillion (US$11.5 billion), an increase of nearly 34 percent compared to last year. Among them, 22 commercial banks achieved growth in business results compared to the previous year, with most reaching their highest levels ever. Of these, seven commercial banks earned profits of over VND20 trillion, including Vietcombank, Techcombank, BIDV, MB, VPBank, Agribank, and VietinBank.

Not only last year but also in the two years of the Covid-19 pandemic, the banking industry still got high profits. Specifically, in 2020, the financial reports of 24 commercial banks listed on the stock exchange showed a pre-tax profit growth of nearly VND151 trillion, an increase of 15.8 percent, a fairly high level compared to many other industries. In 2021, the total pre-tax profit of 24 commercial banks also exceeded VND197 trillion, an increase of 35.8 percent compared to 2020.

At the National Assembly session in June 2022, in response to questions from deputies about why the banking sector made such huge profits during the two years of the Covid-19 pandemic while many people struggled, many bank loans became overdue, and many businesses went bankrupt, the Governor of the State Bank of Vietnam (SBV), Nguyen Thi Hong, stated that credit institutions are also businesses established with the goal of generating revenue and profit. Banks are financial intermediaries that earn income from interest and other services, but their operations are closely linked to risks, and non-performing loans are unavoidable. Financial resources are also needed to be set aside to handle these risks. However, credit institutions have extremely large capital and asset scales compared to other businesses. By the end of 2020, the entire credit institution system had total assets of VND14 quadrillion, which increased to over VND16 quadrillion by March 2022. According to the Governor of SBV, if the assets of a State-owned commercial bank are about VND1.7 quadrillion, then a profit of VND20 trillion is not considered high. The profitability ratio on capital of some credit institutions is not higher than that of businesses in other industries.

Banks are also businesses, and the fact that capital mobilization from the public by banks must be done efficiently and profitably is reasonable. However, in the context of a capital market facing many difficulties, credit capital is considered a driving force for growth. The banking industry has also been assigned to manage reasonable credit growth by the Prime Minister, ensuring sufficient capital for the economy with reasonable borrowing costs and interest rates. Meanwhile, the skyrocketing interest rates will lead to the bankruptcy of businesses and will adversely affect economic growth.

Mr. Nguyen Minh Duc, the head of the Legal Affairs Committee of the Vietnam Chamber of Commerce and Industry, said that banks must also compete and earn profits, but the huge profit in the banking industry in the current difficult economic situation is abnormal. According to Mr. Duc, this may indicate that profits come from not only interest rate hikes but also policies. The profits of the banking industry in 2022 are equivalent to about 2.3 percent of the total outstanding loans of the entire banking system. This profit figure is enough to lower the interest rates of the entire banking system by 2.3 percentage points.

Reducing the burden on businesses

Experts said that Vietnam's interest rates are too high while inflation is low, which is illogical. Specifically, Vietnam's inflation in 2022 was controlled at 3.15 percent and is projected to be below 4.5 percent in 2023. Meanwhile, savings interest rates increased from 9.5-13 percent per annum since October 2022 and are currently maintained at a maximum of 9.5 percent per annum. Therefore, the real interest rate is twice as high as the inflation rate. Currently, Vietnam has the highest real interest rate in the world, while some countries even apply negative real interest rates, reducing lending rates to support economic development and growth. For instance, Malaysia's inflation rate is 3-4 percent, but its deposit interest rates are only 2.5-3.5 percent per annum, and the lending rates are 5-6 percent per annum. Recently, China has reduced its first-time homebuyers' lending rates to 4.1 percent per annum or lower (previously at 5.74 percent per annum).

|

Top ten commercial banks with highest pre-tax profits in 2021 and 2022. (Photo: SGGP) |

High mobilization interest rates have pushed lending rates for customers up to 12-15 percent per annum, even higher, making it difficult for borrowers to bear the high borrowing costs. Speaking at a recent seminar held in Ho Chi Minh City, Associate Professor - Dr. Tran Dinh Thien, former Director of the Vietnam Institute of Economics, affirmed that no business can survive with a lending interest rate of 15-16 percent per annum.

Mr. Le Xuan Nghia, a member of the National Financial and Monetary Policy Advisory Council, said that if inflation were at around 4 percent, a savings interest rate of about 6-7 percent per annum would be appropriate, thereby helping to make lending rates more bearable for businesses than they are currently. Currently, Vietnam is one of the countries with the highest lending interest rates in the world. With this interest rate level, domestic businesses will weaken and find it difficult to compete with foreign ones, which do not have to bear the high interest rates of the Vietnamese banking system. Therefore, the management agencies need to quickly apply measures to reduce interest rates to promote credit growth because the delay of the monetary policy usually takes about six months.

Experts believe that with an abundant supply of foreign currency, improved liquidity in the market, and a sharp drop in exchange rate pressure, it is an opportunity for the SBV to increase foreign currency reserves, increase the supply of Vietnamese dong, and reduce the pressure on domestic interest rates. According to Mr. Truong Van Phuoc, a member of the Prime Minister's Economic Advisory Team, the USD/VND exchange rate has depreciated sharply in the past three months, with the US Dollar Index decreasing by 6.5 percent. The Vietnamese monetary market has its own peculiarities but is still influenced by the global context. However, Vietnam's inflation in 2023 is expected to continue to be controlled at around 4 percent, and the country has many favorable conditions to lower interest rates and increase the money supply higher than in 2022.

According to Mr. Phuoc, two factors can solve the issue of interest rates: monetary supply and liquidity of credit institutions. Overall, the level of money supply needs to meet the demand of the economy. However, if a part of credit institutions has liquidity difficulties, the deposit interest rates will be pushed up, resulting in high lending interest rates. At this point, the role of the SBV in ensuring liquidity for credit institutions is crucial to reduce deposit interest rates. The VND interest rates can be lowered if the SBV recapitalizes credit institutions at an appropriate interest rate in line with the monetary policy objectives. In addition, it is necessary to establish a reliable interbank deposit market that actively supports credit institutions in terms of cash flow and liquidity. This is an important factor for reducing interest rates and easing the burden on businesses.

Mr. DAO MINH TU, Deputy Governor of the SBV: SBV will continue to cut interest rates

This year, the SBV will continue to implement interest rate and flexible exchange rate policies to ensure the confidence of businesses and people. In favorable conditions, the SBV will continue to direct credit institutions to reduce costs to lower interest rates compared to the committed level at the end of 2022. In reality, the SBV is striving to lower lending rates through system support. Currently, interest rates in the market have gradually cooled down.