A business has recently arrived at Sai Gon Giai Phong Newspaper to call for help after over VND26 billion (US$1.17 billion) on deposit at VPBank disappeared but the bank has shirked its responsibility, saying the employee who did the wrong thing has been off work.

The business is Quang Huan Investment and Development Company headquartering in Cu Chi district and specializing in trading farm produce.

At the end of March last year, the company opened an account at Vietnam Prosperity Joint Stock Commercial Bank (VP Bank) to make payments from its customer with the total transferred money estimated to reach VND26 billion.

At the end of July the same year, the company’s director Tran Thi Thanh Xuan, came to the bank to withdraw money and knew that the VND26 billion had vaporized.

She wanted to check her account but the bank’s staff asked her to do a procedure to change signature because it was unlike her signature in previous transactions.

Looking at the account statement, Ms. Xuan was surprising as money had continuously been withdrawn from her account or transferred to another account with checks while she has never bought any check.

The account statement specified that the person who purchased her company’s checks is VPBank employee Doan Thi Thuy Hang. Those cashing the cheque include Hang’s husband Nguyen Huy Nhut and two friends namely Do Binh Bao and Pham Van Trinh.

During a short time, Nhut, Bao and Trinh used the checks that Hang bought to withdraw or transfer money into Thanh Tam Company in the name of Pham Van Trinh.

Right after openning the account, Ms. Xuan did register mobile banking service to inform her of transactions. Although the account statement shows that the bank charged mobile banking fees sufficiently but she did not receive any message about the above transactions.

Since July 2015, she has been lodging complaints to the bank in vain as the bank denied its responsibility with the reason that Hang has been off work, the case has been sent to the police agency and only the police has the right to invite Hang for investigation, not the bank.

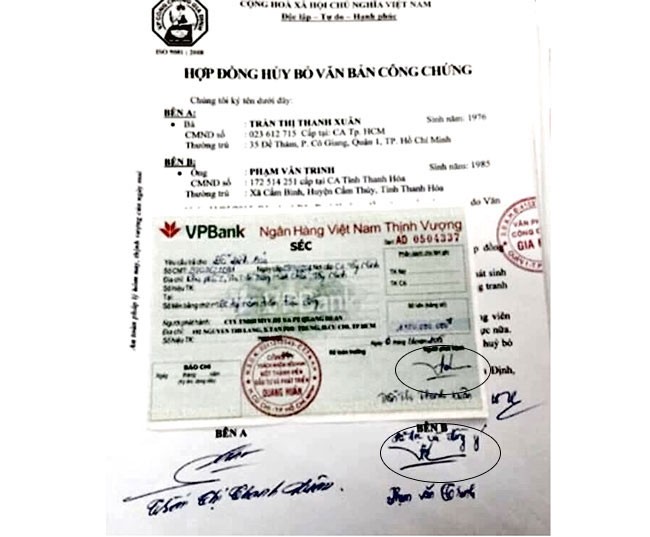

Receiving Sai Gon Giai Phong reporters, head of VPBank communications division Dam Thanh Huong showed documents related to the transactions. Although the name in these documents is Tran Thi Thanh Xuan, the signature is in fact of Pham Van Trinh.

Ms. Xuan provided the handwriting and signature of Pham Van Trinh from notary public offices and tax agencies to compare and find the signature in the documents at the bank is really of Trinh.

The documents that the bank provided are copies and all signatures and handwriting on these are not of Ms. Xuan. In contracts directly signed between Quang Huan Company and the director of VPBank, the signature is also from Pham Van Trinh.

SGGP required the bank to show camera footages on the days of transactions to determine the person who signed the contracts and documents but the bank made another appointment.

Ms. Xuan asked the bank to provide original documents but it refused for security reasons and requested her to make a sealed application.

“If the bank had such good security, I should not have lost my money,” Ms. Xuan said.

If there was no collusion from the bank’s employee, a man could not falsely assumed a woman whose name includes ‘Thi’ to conduct transactions. Only female Vietnamese have the middle name of Thi.

The bank has kept saying that Doan Thi Thuy Hang has been off work and not cooperated with Ms. Xuan to clarify the illegal cheque purchase and money withdrawal and transfer from her account.

According to the law, although the employee has stopped working, the bank must take responsibility for violations she caused previously with the status of the bank staff.

Ms. Xuan has sent a letter of denunciation to the Criminal Investigation Agency on Economic Management (PC46) under the HCMC Police Department since September last year but somehow the case has not been settled so far.

)

)